Capital One 2015 Annual Report Download - page 92

Download and view the complete annual report

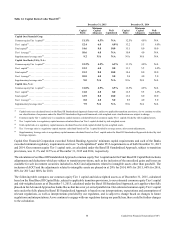

Please find page 92 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.73 Capital One Financial Corporation (COF)

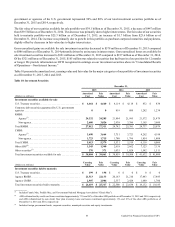

Below we provide an overview of how we manage our eight primary risk categories.

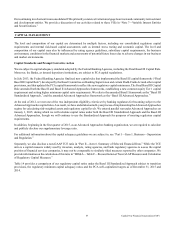

Compliance Risk Management

We recognize that compliance requirements for financial institutions are increasingly complex and that there are heightened

expectations from our regulators and our customers. In response, we continuously evaluate the regulatory environment and

proactively adjust our compliance risk program to fully address these expectations.

Our Compliance Management Program establishes expectations for determining compliance requirements, assessing the risk of

new product offerings, creating appropriate controls and training to address requirements, monitoring for control performance,

and independently testing for adherence to compliance requirements. The program also establishes regular compliance reporting

to senior business leaders, the executive committee and the Board of Directors.

The Chief Compliance Officer is responsible for establishing and overseeing our Compliance Risk Management Program. Business

areas incorporate compliance requirements and controls into their business policies, standards, processes and procedures. They

regularly monitor and report on the efficacy of their compliance controls and Corporate Compliance periodically independently

tests to validate the effectiveness of business controls.

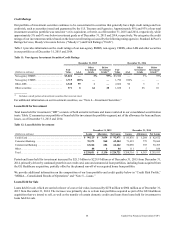

Credit Risk Management

We recognize that we are exposed to cyclical changes in credit quality. Consequently, we try to ensure our credit portfolio is resilient

to economic downturns. Our most important tool in this endeavor is sound underwriting. In unsecured consumer loan underwriting,

we generally assume that loans will be subject to an environment in which losses are higher than those prevailing at the time of

underwriting. In commercial underwriting, we generally require strong cash flow, collateral and covenants and guarantees. In

addition to sound underwriting, we continually monitor our portfolio and take steps to collect or work out distressed loans.

The Chief Risk Officer, in conjunction with the Consumer and Commercial Chief Credit Officers, is responsible for establishing

credit risk policies and procedures, including underwriting and hold guidelines and credit approval authority, and monitoring credit

exposure and performance of our lending-related transactions. These responsibilities are fulfilled by the Chief Consumer Credit

Officer and the Chief Commercial Credit Officer who are responsible for evaluating the risk implications of credit strategy and

for oversight of credit for both the existing portfolio and any new credit investments. The Chief Consumer Credit Officer and the

Chief Commercial Credit Officer have formal approval authority for various types and levels of credit decisions, including individual

commercial loan transactions. Division Presidents within each segment are responsible for managing the credit risk within their

divisions and maintaining processes to control credit risk and comply with credit policies and guidelines. In addition, the Chief

Risk Officer establishes policies, delegates approval authority and monitors performance for non-loan credit exposure entered into

with financial counterparties or through the purchase of credit sensitive securities in our investment portfolio.

Our credit policies establish standards in five areas: customer selection, underwriting, monitoring, remediation, and portfolio

management. The standards in each area provide a framework comprising specific objectives and control processes. These standards

are supported by detailed policies and procedures for each component of the credit process. Starting with customer selection, our

goal is to generally provide credit on terms that generate above hurdle returns. We use a number of quantitative and qualitative

factors to manage credit risk, including setting credit risk limits and guidelines for each of our lines of business. We monitor

performance relative to these guidelines and report results and any required mitigating actions to appropriate senior management

committees and our Board of Directors.

Legal Risk Management

The General Counsel provides legal evaluation and guidance to the enterprise and business areas and partners with other risk

management functions such as Compliance and Internal Audit. This evaluation and guidance is based on an assessment of the type

and degree of legal risk associated with the internal business area practices and activities and of the controls the business has in

place to mitigate legal risks.