Capital One 2015 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

157 Capital One Financial Corporation (COF)

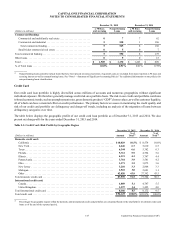

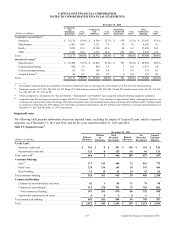

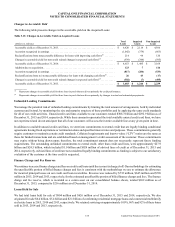

Table 5.11: TDR—Subsequent Defaults

Year Ended December 31,

2015 2014 2013

(Dollars in millions)

Number of

Contracts Amount

Number of

Contracts Amount

Number of

Contracts Amount

Credit Card:

Domestic credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . 42,808 $ 71 40,814 $ 63 41,859 $ 72

International credit card(1) . . . . . . . . . . . . . . . . . . . . . . . 33,888 81 38,195 106 47,688 138

Total credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76,696 152 79,009 169 89,547 210

Consumer Banking:

Auto . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,647 99 6,651 72 9,525 68

Home loan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 2 24 5 33 3

Retail banking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26 2 75 10 126 7

Total consumer banking . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,687 103 6,750 87 9,684 78

Commercial Banking:

Commercial and multifamily real estate . . . . . . . . . . . . 0 0 5 11 14 23

Commercial and industrial . . . . . . . . . . . . . . . . . . . . . . 7 19 2 1 24 22

Total commercial lending . . . . . . . . . . . . . . . . . . . . . . 7 19 7 12 38 45

Small-ticket commercial real estate. . . . . . . . . . . . . . . . 3 0 33 3 4 0

Total commercial banking . . . . . . . . . . . . . . . . . . . . . . . . . 10 19 40 15 42 45

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85,393 $ 274 85,799 $ 271 99,273 $ 333

___________

(1) In the U.K., regulators require the acceptance of payment plan proposals in which the modified payments may be less than the contractual minimum amount.

As a result, loans entering long-term TDR payment programs in the U.K. typically continue to age and ultimately charge-off even when fully in compliance

with the TDR program terms.

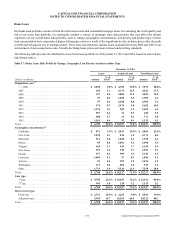

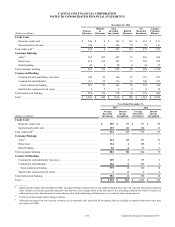

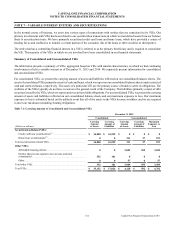

Acquired Loans Accounted for Based on Expected Cash Flows

Outstanding Balance and Carrying Value of Acquired Loans

The table below presents the outstanding balance and the carrying value of Acquired Loans that are accounted for based on expected

cash flows to be collected as of December 31, 2015 and 2014. The table separately displays loans considered impaired due to their

deterioration in credit quality at acquisition and loans not considered impaired at acquisition.

Table 5.12: Acquired Loans Accounted for Based on Expected Cash Flows

December 31, 2015 December 31, 2014

(Dollars in millions) Total

Impaired

Loans

Non-Impaired

Loans Total

Impaired

Loans

Non-Impaired

Loans

Outstanding balance(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 21,151 $ 3,840 $ 17,311 $ 25,201 $ 4,279 $ 20,922

Carrying value(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,516 2,629 16,887 23,519 2,882 20,637

__________

(1) Includes Acquired Loans from the GE Healthcare acquisition, with an outstanding balance and carrying value of $957 million and $847 million, respectively.

The gross contractual cash flows of these Acquired Loans were $1.1 billion, of which $138 million are not expected to be collected.

(2) Includes $37 million and $27 million of allowance for loan and lease losses for these loans as of December 31, 2015 and 2014, respectively. We recorded a

$10 million provision and a $11 million release of the allowance for credit losses for the years ended December 31, 2015 and 2014, respectively, for Acquired

Loans.