Capital One 2015 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

168 Capital One Financial Corporation (COF)

Goodwill

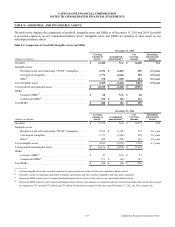

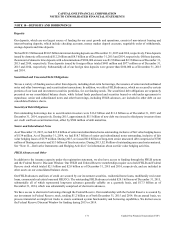

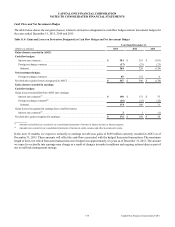

The following table presents goodwill attributable to each of our business segments as of December 31, 2015 and 2014.

Table 8.2: Goodwill Attributable to Business Segments

(Dollars in millions)

Credit

Card

Consumer

Banking

Commercial

Banking Total

Balance as of December 31, 2013. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,005 $ 4,585 $ 4,388 $ 13,978

Acquisitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 10 0 12

Other adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6) (2) (4) (12)

Balance as of December 31, 2014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,001 4,593 4,384 13,978

Acquisitions (1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 7 500 508

Other adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5) 0 (1) (6)

Balance as of December 31, 2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,997 $ 4,600 $ 4,883 $ 14,480

__________

(1) In connection with the GE Healthcare acquisition, we recorded goodwill of $500 million representing the amount by which the purchase price exceeded the

fair value of the net assets acquired. The goodwill was assigned to the Commercial Banking segment. See “Note 2—Business Developments” for additional

information about this acquisition.

Goodwill was not impaired as of December 31, 2015 or 2014, nor was any goodwill written off due to impairment during 2015,

2014 or 2013. The goodwill impairment test, performed as of October 1 of each year, is a two-step test. The first step identifies

whether there is potential impairment by comparing the fair value of a reporting unit to its carrying amount, including goodwill.

If the fair value of a reporting unit is less than its carrying amount, the second step of the impairment test is required to measure

the amount of any potential impairment loss.

The fair value of reporting units is calculated using a discounted cash flow methodology, a form of the income approach. The

calculation uses projected cash flows based on each reporting unit’s internal forecast and uses the perpetuity growth method to

calculate terminal values. These cash flows and terminal values are then discounted using appropriate discount rates, which are

largely based on our external cost of equity with adjustments for risk inherent in each reporting unit. Cash flows are adjusted, as

necessary, in order to maintain each reporting unit’s equity capital requirements. Our discounted cash flow analysis requires

management to make judgments about future loan and deposit growth, revenue growth, credit losses, and capital rates. Discount

rates used in 2015 for the reporting units ranged from 8% to 13%. The key inputs into the discounted cash flow analysis were

consistent with market data, where available, indicating that assumptions used were within a reasonable range of observable market

data. Based on our analysis, fair value exceeded the carrying amount for all reporting units as of our annual testing date; therefore,

the second step of impairment testing was unnecessary.

Intangible Assets

In connection with our acquisitions, we recorded intangible assets which include purchased credit card relationship (“PCCR”)

intangibles, core deposit intangibles, brokerage relationship intangibles, partnership contract intangibles, other contract intangibles,

trademark intangibles and other intangibles, which are subject to amortization. At acquisition, the PCCR intangibles reflect the

estimated value of existing credit card holder relationships and the core deposit intangibles reflect the estimated value of deposit

relationships. We did not record any material impairment on intangible assets during 2015 or 2014.

Intangible assets are typically amortized over their respective estimated useful lives on either an accelerated or straight-line basis.

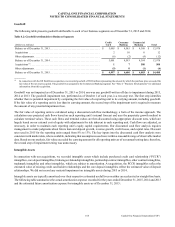

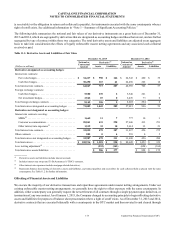

The following table summarizes the actual amortization expense recorded for the years ended December 31, 2015, 2014 and 2013

and the estimated future amortization expense for intangible assets as of December 31, 2015: