Capital One 2015 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

209 Capital One Financial Corporation (COF)

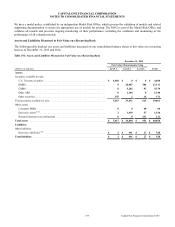

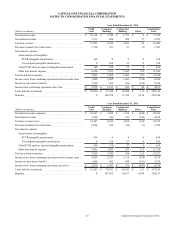

NOTE 20—BUSINESS SEGMENTS

Our principal operations are currently organized into three major business segments, which are defined based on the products and

services provided or the type of customer served: Credit Card, Consumer Banking and Commercial Banking. The operations of

acquired businesses have been integrated into our existing business segments. Certain activities that are not part of a segment,

such as management of our corporate investment portfolio and asset/liability management by our centralized Corporate Treasury

group, are included in the Other category.

• Credit Card: Consists of our domestic consumer and small business card lending, and the international card lending

businesses in Canada and the United Kingdom.

• Consumer Banking: Consists of our branch-based lending and deposit gathering activities for consumers and small

businesses, national deposit gathering, national auto lending and consumer home loan lending and servicing activities.

• Commercial Banking: Consists of our lending, deposit gathering and treasury management services to commercial real

estate and commercial and industrial customers. Our commercial and industrial customers typically include companies with

annual revenues between $10 million to $1 billion.

• Other category: Includes the residual impact of the allocation of our centralized Corporate Treasury group activities, such

as management of our corporate investment portfolio and asset/liability management, to our business segments. Accordingly,

net gains and losses on our investment securities portfolio and certain trading activities are included in the Other category.

Other category also includes foreign exchange-rate fluctuations on foreign currency-denominated transactions; unallocated

corporate expenses that do not directly support the operations of the business segments or for which the business segments

are not considered financially accountable in evaluating their performance, such as acquisition and restructuring charges;

certain provisions for representation and warranty reserves related to continuing operations; certain material items that are

non-recurring in nature; and offsets related to certain line-item reclassifications.

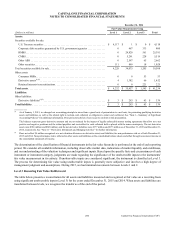

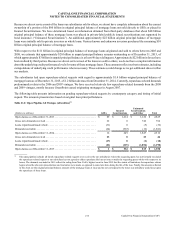

Basis of Presentation

We report the results of each of our business segments on a continuing operations basis. See “Note 3—Discontinued Operations”

for a discussion of discontinued operations. The results of our individual businesses reflect the manner in which management

evaluates performance and makes decisions about funding our operations and allocating resources.

Business Segment Reporting Methodology

The results of our business segments are intended to reflect each segment as if it were a stand-alone business. Our internal

management and reporting process used to derive our segment results employs various allocation methodologies, including funds

transfer pricing, to assign certain balance sheet assets, deposits and other liabilities and their related revenue and expenses directly

or indirectly attributable to each business segment. Our funds transfer pricing process provides a funds credit for sources of funds,

such as deposits generated by our Consumer Banking and Commercial Banking businesses, and a funds charge for the use of funds

by each segment. Due to the integrated nature of our business segments, estimates and judgments have been made in allocating

certain revenue and expense items. Transactions between segments are based on specific criteria or approximate third-party rates.

We regularly assess the assumptions, methodologies and reporting classifications used for segment reporting, which may result

in the implementation of refinements or changes in future periods.

The following is additional information on the principles and methodologies used in preparing our business segment results.

• Net interest income: Interest income from loans held for investment and interest expense from deposits and other interest-

bearing liabilities are reflected within each applicable business segment. Because funding and asset/liability management

are managed centrally by our Corporate Treasury Group, net interest income for our business segments also includes the

results of a funds transfer pricing process that is intended to allocate a cost of funds used or credit for funds provided to all

business segment assets and liabilities, respectively, using a matched funding concept. Also, the taxable-equivalent benefit

of tax-exempt products is allocated to each business unit with a corresponding increase in income tax expense.

• Non-interest income: Non-interest fees and other revenue associated with loans or customers managed by each business

segment and other direct revenues are accounted for within each business segment.