Capital One 2015 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

132 Capital One Financial Corporation (COF)

We record valuation allowances to reduce deferred tax assets to the amount that is more likely than not to be realized. See “Note 18

—Income Taxes” for additional detail.

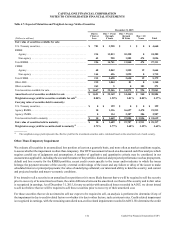

Earnings Per Share

Earnings per share is calculated and reported under the “two-class” method. The “two-class” method is an earnings allocation

method under which earnings per share is calculated for each class of common stock and participating security considering both

dividends declared or accumulated and participation rights in undistributed earnings as if all such earnings had been distributed

during the period. We have unvested share-based payment awards which have a right to receive nonforfeitable dividends. These

share-based payment awards are deemed to be participating securities.

Earnings per common share is calculated by dividing net income, after deducting dividends on preferred stock and undistributed

earnings allocated to participating securities, by the average number of common shares outstanding during the period, net of any

treasury shares. We calculate diluted earnings per share by dividing net income, after deducting dividends on preferred stock and

undistributed earnings allocated to participating securities, by the average number of common shares outstanding during the period,

net of any treasury shares, after consideration of the potential dilutive effect of common stock equivalents. Common stock

equivalents include warrants, stock options, restricted stock awards and units and performance share awards and units. Common

stock equivalents are calculated based upon the treasury stock method using an average market price of common shares sold during

the period. Dilution is not considered when the Company is in a net loss position. Common stock equivalents that have an antidilutive

effect are excluded from the computation of diluted earnings per share.

Derivative Instruments and Hedging Activities

All derivative financial instruments, whether designated for hedge accounting or not, are reported at their fair value on our

consolidated balance sheets as either assets or liabilities, with consideration of legally enforceable master netting arrangements

that allow us to net settle positive and negative positions and offset cash collateral with the same counterparty. We report net

derivatives in a gain position, or derivative assets, on our consolidated balance sheets as a component of other assets. We report

net derivatives in a loss position, or derivative liabilities, on our consolidated balance sheets as a component of other liabilities.

See “Note 11—Derivative Instruments and Hedging Activities” for additional detail on the accounting for derivative instruments,

including those designated as qualifying for hedge accounting.

Fair Value

Fair value is defined as the price that would be received for an asset or paid to transfer a liability in an orderly transaction between

market participants on the measurement date (also referred to as an exit price). The fair value accounting guidance provides a

three-level fair value hierarchy for classifying financial instruments. This hierarchy is based on whether the inputs to the valuation

techniques used to measure fair value are observable or unobservable. Fair value measurement of a financial asset or liability is

assigned to a level based on the lowest level of any input that is significant to the fair value measurement in its entirety. The three

levels of the fair value hierarchy are described below:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities

Level 2: Observable market-based inputs, other than quoted prices in active markets for identical assets or liabilities

Level 3: Unobservable inputs

The accounting guidance for fair value requires that we maximize the use of observable inputs and minimize the use of unobservable

inputs in determining fair value. The accounting guidance also provides for the irrevocable option to elect, on a contract-by-contract

basis, to measure certain financial assets and liabilities at fair value at inception of the contract and record any subsequent changes

in fair value into income. We have not made any material fair value option elections as of and for the years ended December 31,

2015, 2014 and 2013. See “Note 19—Fair Value Measurement” for additional information.

Accounting for Acquisitions

We account for business combinations under the acquisition method of accounting. Under the acquisition method, tangible and

intangible identifiable assets acquired, liabilities assumed and any noncontrolling interest in the acquiree are recorded at fair value