Capital One 2015 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

177 Capital One Financial Corporation (COF)

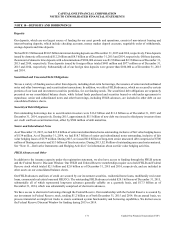

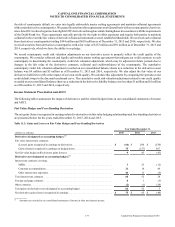

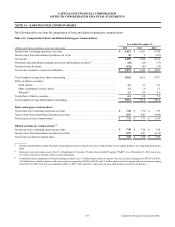

the risk of counterparty default, we enter into legally enforceable master netting agreements and maintain collateral agreements

with certain derivative counterparties. We generally enter into these agreements on a bilateral basis with our counterparties; however,

since June 2013 we have begun to clear eligible OTC derivatives through a central clearinghouse in accordance with the requirements

of the Dodd-Frank Act. These agreements typically provide for the right to offset exposures and require both parties to maintain

collateral in the event the fair values of derivative financial instruments exceed established thresholds. We received cash collateral

from derivatives counterparties totaling $544 million and $695 million as of December 31, 2015 and 2014, respectively. We also

received securities from derivatives counterparties with a fair value of $172 million and $91 million as of December 31, 2015 and

2014, respectively, which we have the ability to re-pledge.

We record counterparty credit risk valuation adjustments on our derivative assets to properly reflect the credit quality of the

counterparty. We consider collateral and legally enforceable master netting agreements that mitigate our credit exposure to each

counterparty in determining the counterparty credit risk valuation adjustment, which may be adjusted in future periods due to

changes in the fair value of the derivatives contracts, collateral and creditworthiness of the counterparty. The cumulative

counterparty credit risk valuation adjustment recorded on our consolidated balance sheets as a reduction in the derivatives asset

balance was $4 million and $5 million as of December 31, 2015 and 2014, respectively. We also adjust the fair value of our

derivatives liabilities to reflect the impact of our own credit quality. We calculate this adjustment by comparing the spreads on our

credit default swaps to the discount benchmark curve. The cumulative credit risk valuation adjustment related to our credit quality

recorded on our consolidated balance sheets as a reduction in the derivative liability balance was less than $1 million and $1 million

as of December 31, 2015 and 2014, respectively.

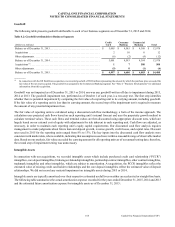

Income Statement Presentation and AOCI

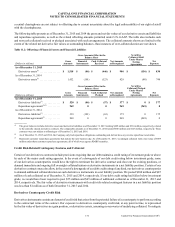

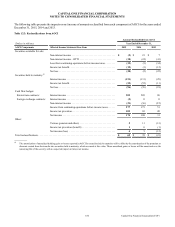

The following tables summarize the impact of derivatives and the related hedged items in our consolidated statements of income

and AOCI.

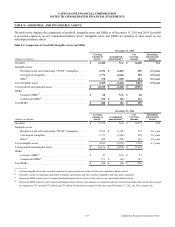

Fair Value Hedges and Free-Standing Derivatives

The net gains (losses) recognized in earnings related to derivatives in fair value hedging relationships and free-standing derivatives

are presented below for the years ended December 31, 2015, 2014 and 2013.

Table 11.3: Gains and Losses on Fair Value Hedges and Free-Standing Derivatives

Year Ended December 31,

(Dollars in millions) 2015 2014 2013

Derivatives designated as accounting hedges:(1)

Fair value interest rate contracts:

(Losses) gains recognized in earnings on derivatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (66) $ 200 $ (550)

Gains (losses) recognized in earnings on hedged items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75 (157) 507

Net fair value hedge ineffectiveness gains (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 943 (43)

Derivatives not designated as accounting hedges:(1)

Interest rate contracts covering:

MSRs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 323 (12)

Customer accommodation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 18 49

Other interest rate exposures. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44 11 (9)

Total interest rate contracts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68 52 28

Foreign exchange contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 01 (5)

Other contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2) (1) (20)

Total gains on derivatives not designated as accounting hedges . . . . . . . . . . . . . . . . . . . . . . . . . 66 52 3

Net derivative gains (losses) recognized in earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 75 $ 95 $ (40)

__________

(1) Amounts are recorded in our consolidated statements of income in other non-interest income.