Capital One 2015 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

214 Capital One Financial Corporation (COF)

Because we do not service most of the loans our subsidiaries sold to others, we do not have complete information about the current

ownership of a portion of the $80 billion in original principal balance of mortgage loans not sold directly to GSEs or placed in

Insured Securitizations. We have determined based on information obtained from third-party databases that about $48 billion

original principal balance of these mortgage loans was placed in private-label publicly issued securitizations not supported by

bond insurance (“Uninsured Securitizations”). An additional approximately $22 billion original principal balance of mortgage

loans were initially sold to private investors as whole loans. Various known and unknown investors purchased the remaining $10

billion original principal balance of mortgage loans.

With respect to the $111 billion in original principal balance of mortgage loans originated and sold to others between 2005 and

2008, we estimate that approximately $20 billion in unpaid principal balance remains outstanding as of December 31, 2015, of

which approximately $3 billion in unpaid principal balance is at least 90 days delinquent. Approximately $22 billion in losses have

been realized by third parties. Because we do not service most of the loans we sold to others, we do not have complete information

about the underlying credit performance levels for some of these mortgage loans. These amounts reflect our best estimates, including

extrapolations of underlying credit performance where necessary. These estimates could change as we get additional data or refine

our analysis.

The subsidiaries had open repurchase-related requests with regard to approximately $1.4 billion original principal balance of

mortgage loans as of December 31, 2015, a $1.2 billion decrease from December 31, 2014. Currently, repurchase-related demands

predominantly relate to the 2006 and 2007 vintages. We have received relatively few repurchase-related demands from the 2008

and 2009 vintages, mostly because GreenPoint ceased originating mortgages in August 2007.

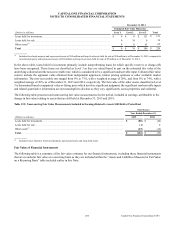

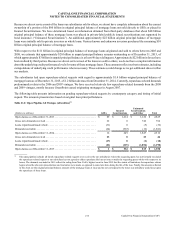

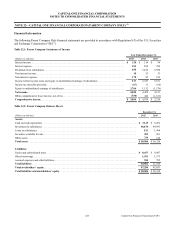

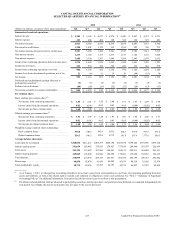

The following table presents information on pending repurchase-related requests by counterparty category and timing of initial

request. The amounts presented are based on original loan principal balances.

Table 21.2: Open Pipeline All Vintages (all entities)(1)

(Dollars in millions) GSEs

Insured

Securitizations

Uninsured

Securitizations

and Other Total

Open claims as of December 31, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 89 $ 1,614 $ 1,122 $ 2,825

Gross new demands received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 0 742 764

Loans repurchased/made whole . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (31) 0 (5) (36)

Demands rescinded. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (64) (965) (12) (1,041)

Open claims as of December 31, 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 649 1,847 2,512

Gross new demands received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 0 23 46

Loans repurchased/made whole . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (17) 0 (1) (18)

Demands rescinded. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (21) (115) (1,054) (1,190)

Open claims as of December 31, 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1 $ 534 $ 815 $ 1,350

__________

(1) The open pipeline includes all timely repurchase-related requests ever received by our subsidiaries where the requesting party has not formally rescinded

the repurchase-related request or our subsidiary has not agreed to either repurchase the loan at issue or make the requesting party whole with respect to its

losses. The demands rescinded in 2015 reflect the ruling from New York’s highest court in June 2015 that the statute of limitations for repurchase claims

begins when the relevant representations and warranties were made, as opposed to some later date during the life of the loan. Finally, the amounts reflected

in this chart are the original principal balance amounts of the mortgage loans at issue and do not correspond to the losses our subsidiary would incur upon

the repurchase of these loans.