Capital One 2015 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

142 Capital One Financial Corporation (COF)

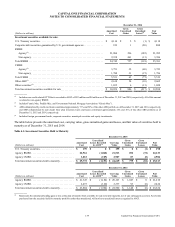

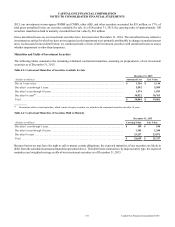

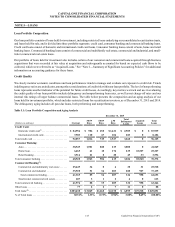

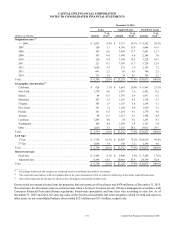

Table 4.7: Expected Maturities and Weighted-Average Yields of Securities

December 31, 2015

(Dollars in millions)

Due in

1 Year or

Less

Due > 1 Year

through

5 Years

Due > 5 Years

through

10 Years

Due > 10

Years Total

Fair value of securities available for sale:

U.S. Treasury securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 701 $ 3,958 $ 1 $ 0 $ 4,660

RMBS:

Agency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 214 13,813 10,258 0 24,285

Non-agency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42 928 1,582 474 3,026

Total RMBS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 256 14,741 11,840 474 27,311

CMBS:

Agency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48 2,042 1,555 19 3,664

Non-agency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 164 456 1,095 0 1,715

Total CMBS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 212 2,498 2,650 19 5,379

Other ABS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 215 1,044 81 0 1,340

Other securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 263 5 0 103 371

Total securities available for sale. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,647 $ 22,246 $ 14,572 $ 596 $ 39,061

Amortized cost of securities available for sale . . . . . . . . . . . . . . . . $ 1,651 $ 22,169 $ 14,444 $ 540 $ 38,804

Weighted-average yield for securities available for sale(1) . . . . . . . 0.80% 1.92% 3.01% 8.82% 2.37%

Carrying value of securities held to maturity:

U.S. Treasury securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0 $ 199 $ 0 $ 0 $ 199

Agency RMBS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 1,336 16,697 3,470 21,513

Agency CMBS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 134 2,387 386 2,907

Total securities held to maturity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10 $ 1,669 $ 19,084 $ 3,856 $ 24,619

Fair value of securities held to maturity . . . . . . . . . . . . . . . . . . . . . $ 10 $ 1,689 $ 19,707 $ 3,911 $ 25,317

Weighted-average yield for securities held to maturity(1) . . . . . . . 5.73% 2.77% 2.48% 3.29% 2.62%

__________

(1) The weighted-average yield represents the effective yield for the investment securities and is calculated based on the amortized cost of each security.

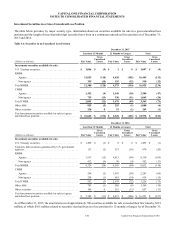

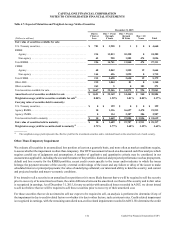

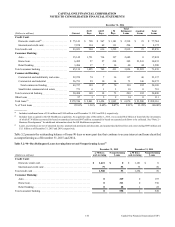

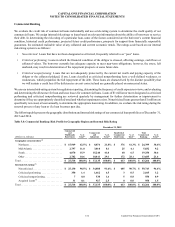

Other-Than-Temporary Impairment

We evaluate all securities in an unrealized loss position at least on a quarterly basis, and more often as market conditions require,

to assess whether the impairment is other-than-temporary. Our OTTI assessment is based on a discounted cash flow analysis which

requires careful use of judgments and assumptions. A number of qualitative and quantitative criteria may be considered in our

assessment as applicable, including the size and the nature of the portfolio; historical and projected performance such as prepayment,

default and loss severity for the RMBS portfolio; recent credit events specific to the issuer and/or industry to which the issuer

belongs; the payment structure of the security; external credit ratings of the issuer and any failure or delay of the issuer to make

scheduled interest or principal payments; the value of underlying collateral; our intent and ability to hold the security; and current

and projected market and macro-economic conditions.

If we intend to sell a security in an unrealized loss position or it is more likely than not that we will be required to sell the security

prior to recovery of its amortized cost basis, the entire difference between the amortized cost basis of the security and its fair value

is recognized in earnings. As of December 31, 2015, for any securities with unrealized losses recorded in AOCI, we do not intend

to sell nor believe that we will be required to sell these securities prior to recovery of their amortized cost.

For those securities that we do not intend to sell nor expect to be required to sell, an analysis is performed to determine if any of

the impairment is due to credit-related factors or whether it is due to other factors, such as interest rates. Credit-related impairment

is recognized in earnings, with the remaining unrealized non-credit-related impairment recorded in AOCI. We determine the credit