Capital One 2015 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

139 Capital One Financial Corporation (COF)

December 31, 2014

(Dollars in millions)

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses(1) Fair

Value

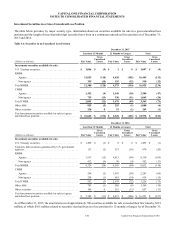

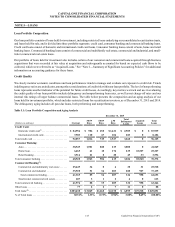

Investment securities available for sale:

U.S. Treasury securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,114 $ 5 $ (1) $ 4,118

Corporate debt securities guaranteed by U.S. government agencies . . . . . . . . . . . . . . . 819 1 (20) 800

RMBS:

Agency(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,804 296 (105) 21,995

Non-agency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,938 461 (13) 3,386

Total RMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24,742 757 (118) 25,381

CMBS:

Agency(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,751 32 (60) 3,723

Non-agency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,780 31 (15) 1,796

Total CMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,531 63 (75) 5,519

Other ABS(3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,618 54 (10) 2,662

Other securities(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,035 6 (13) 1,028

Total investment securities available for sale. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 38,859 $ 886 $ (237) $ 39,508

__________

(1) Includes non-credit-related OTTI that is recorded in AOCI of $22 million and $8 million as of December 31, 2015 and 2014, respectively. All of this amount

is related to non-agency RMBS.

(2) Includes Fannie Mae, Freddie Mac, and Government National Mortgage Association (“Ginnie Mae”).

(3) ABS collateralized by credit card loans constituted approximately 71% and 56% of the other ABS portfolio as of December 31, 2015 and 2014, respectively,

and ABS collateralized by auto dealer floor plan inventory loans and leases constituted approximately 11% and 16% of the other ABS portfolio as of

December 31, 2015 and 2014, respectively.

(4) Includes foreign government bonds, corporate securities, municipal securities and equity investments.

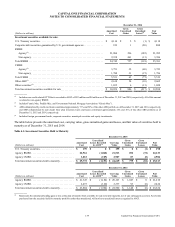

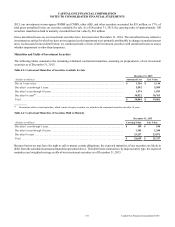

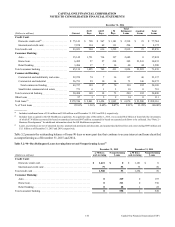

The table below presents the amortized cost, carrying value, gross unrealized gains and losses, and fair value of securities held to

maturity as of December 31, 2015 and 2014.

Table 4.3: Investment Securities Held to Maturity

December 31, 2015

(Dollars in millions)

Amortized

Cost

Unrealized

Losses Recorded

in AOCI(1) Carrying

Value

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

U.S. Treasury securities . . . . . . . . . . . . . . . . . . . . . . . . . . $ 199 $ 0 $ 199 $ 0 $ (1) $ 198

Agency RMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22,561 (1,048) 21,513 692 (72) 22,133

Agency CMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,012 (105) 2,907 87 (8) 2,986

Total investment securities held to maturity. . . . . . . . . . . $ 25,772 $ (1,153) $ 24,619 $ 779 $ (81) $ 25,317

December 31, 2014

(Dollars in millions)

Amortized

Cost

Unrealized

Losses Recorded

in AOCI(1) Carrying

Value

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Agency RMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 21,347 $ (1,184) $ 20,163 $ 1,047 $ 0 $ 21,210

Agency CMBS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,457 (120) 2,337 93 (6) 2,424

Total investment securities held to maturity. . . . . . . . . . . $ 23,804 $ (1,304) $ 22,500 $ 1,140 $ (6) $ 23,634

__________

(1) Represents the unrealized holding gain or loss at the date of transfer from available for sale to held to maturity, net of any subsequent accretion. Any bonds

purchased into the securities held for maturity portfolio rather than transferred, will not have unrealized losses recognized in AOCI.