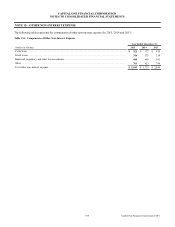

Capital One 2015 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

176 Capital One Financial Corporation (COF)

a central clearinghouse are not subject to offsetting due to current uncertainty about the legal enforceability of our right of setoff

with the clearinghouses.

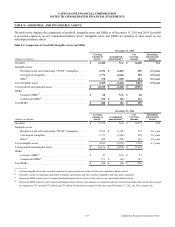

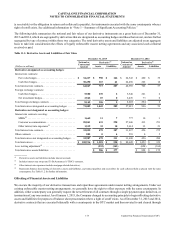

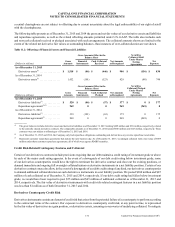

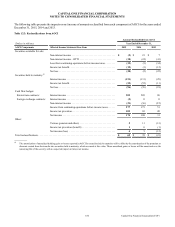

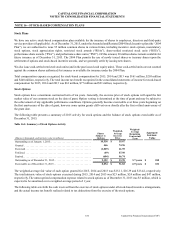

The following table presents as of December 31, 2015 and 2014 the gross and net fair values of our derivative assets and liabilities

and repurchase agreements, as well as the related offsetting amounts permitted under U.S. GAAP. The table also includes cash

and non-cash collateral received or pledged associated with such arrangements. The collateral amounts shown are limited to the

extent of the related net derivative fair values or outstanding balances, thus instances of over-collateralization are not shown.

Table 11.2: Offsetting of Financial Assets and Financial Liabilities

Gross

Amounts

Gross Amounts Offset in the

Balance Sheet

Net Amounts

as Recognized

Securities

Collateral Held

Under Master

Netting

Agreements

(Dollars in millions)

Financial

Instruments

Cash Collateral

Received

Net

Exposure

As of December 31, 2015

Derivatives assets(1) . . . . . . . . . . . . . . . . $ 1,518 $ (86) $ (446) $ 986 $ (156) $ 830

As of December 31, 2014

Derivatives assets(1) . . . . . . . . . . . . . . . . 1,452 (101) (523) 828 (80) 748

Gross

Amounts

Gross Amounts Offset in the

Balance Sheet

Net Amounts

as Recognized

Securities

Collateral Pledged

Under Master

Netting

Agreements

(Dollars in millions)

Financial

Instruments

Cash Collateral

Pledged

Net

Exposure

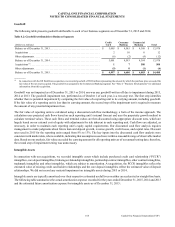

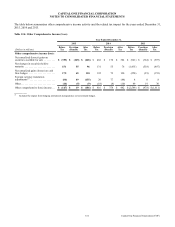

As of December 31, 2015

Derivatives liabilities(1). . . . . . . . . . . . . . $ 520 $ (86) $ (57) $ 377 $ 0 $ 377

Repurchase agreements(2)(3) . . . . . . . . . . 969 0 0 969 (969) 0

As of December 31, 2014

Derivatives liabilities(1). . . . . . . . . . . . . . 339 (101) (63) 175 0 175

Repurchase agreements(2) . . . . . . . . . . . . 869 0 0 869 (869) 0

__________

(1) The gross balances include derivative assets and derivative liabilities as of December 31, 2015 totaling $429 million and $314 million, respectively, related

to the centrally cleared derivative contracts. The comparable amounts as of December 31, 2014 totaled $360 million and $127 million, respectively. These

contracts were not subject to offsetting as of December 31, 2015 and 2014.

(2) As of December 31, 2015 and 2014, the Company only had repurchase obligations outstanding and did not have any reverse repurchase receivables.

(3) Represents customer repurchase agreements that mature the next business day. As of December 31, 2015, we pledged collateral with a fair value of $989

million under these customer repurchase agreements, all of which were agency RMBS securities.

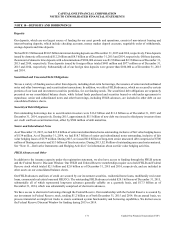

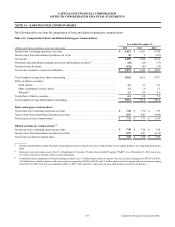

Credit Risk-Related Contingency Features and Collateral

Certain of our derivatives contracts include provisions requiring that our debt maintain a credit rating of investment grade or above

by each of the major credit rating agencies. In the event of a downgrade of our debt credit rating below investment grade, some

of our derivatives counterparties would have the right to terminate the derivative contract and close out the existing positions, or

demand immediate and ongoing full overnight collateralization on derivative instruments in a net liability position. Certain of our

derivatives contracts may also allow, in the event of a downgrade of our debt credit rating of any kind, our derivatives counterparties

to demand additional collateralization on such derivatives instruments in a net liability position. We posted $304 million and $87

million of cash collateral as of December 31, 2015 and 2014, respectively. If our debt credit rating had fallen below investment

grade, we would have been required to post $55 million and $65 million of additional collateral as of December 31, 2015 and

2014, respectively. The fair value of derivatives instruments with credit risk-related contingent features in a net liability position

was less than $1 million as of both December 31, 2015 and 2014.

Derivatives Counterparty Credit Risk

Derivatives instruments contain an element of credit risk that arises from the potential failure of a counterparty to perform according

to the contractual terms of the contract. Our exposure to derivatives counterparty credit risk, at any point in time, is represented

by the fair value of derivatives in a gain position, or derivatives assets, assuming no recoveries of underlying collateral. To mitigate