Capital One 2015 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

152 Capital One Financial Corporation (COF)

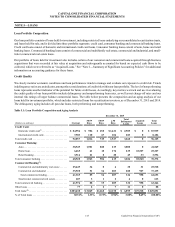

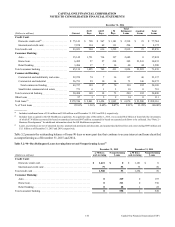

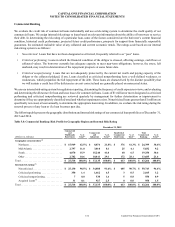

Commercial Banking

We evaluate the credit risk of commercial loans individually and use a risk-rating system to determine the credit quality of our

commercial loans. We assign internal risk ratings to loans based on relevant information about the ability of borrowers to service

their debt. In determining the risk rating of a particular loan, some of the factors considered are the borrower’s current financial

condition, historical credit performance, projected future credit performance, prospects for support from financially responsible

guarantors, the estimated realizable value of any collateral and current economic trends. The ratings scale based on our internal

risk-rating system is as follows:

• Noncriticized: Loans that have not been designated as criticized, frequently referred to as “pass” loans.

• Criticized performing: Loans in which the financial condition of the obligor is stressed, affecting earnings, cash flows or

collateral values. The borrower currently has adequate capacity to meet near-term obligations; however, the stress, left

unabated, may result in deterioration of the repayment prospects at some future date.

• Criticized nonperforming: Loans that are not adequately protected by the current net worth and paying capacity of the

obligor or the collateral pledged, if any. Loans classified as criticized nonperforming have a well-defined weakness, or

weaknesses, which jeopardize the full repayment of the debt. These loans are characterized by the distinct possibility that

we will sustain a credit loss if the deficiencies are not corrected and are generally placed on nonaccrual status.

We use our internal risk-rating system for regulatory reporting, determining the frequency of credit exposure reviews, and evaluating

and determining the allowance for loan and lease losses for commercial loans. Loans of $1 million or more designated as criticized

performing and criticized nonperforming are reviewed quarterly by management for further deterioration or improvement to

determine if they are appropriately classified/rated and whether impairment exists. Noncriticized loans greater than $1 million are

specifically reviewed, at least annually, to determine the appropriate loan rating. In addition, we evaluate the risk rating during the

renewal process of any loan or if a loan becomes past due.

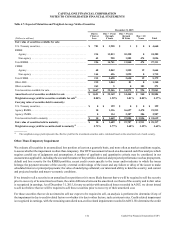

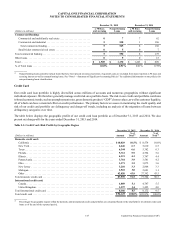

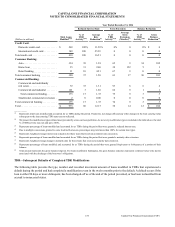

The following table presents the geographic distribution and internal risk ratings of our commercial loan portfolio as of December 31,

2015 and 2014.

Table 5.8: Commercial Banking: Risk Profile by Geographic Region and Internal Risk Rating

December 31, 2015

(Dollars in millions)

Commercial

and

Multifamily

Real Estate

% of

Total(1)

Commercial

and

Industrial

% of

Total(1)

Small-ticket

Commercial

Real Estate

% of

Total(1)

Total

Commercial

Banking

% of

Total(1)

Geographic concentration:(2)

Northeast . . . . . . . . . . . . . . . . . . . . . . . . . . $ 15,949 62.5% $ 8,074 21.8% $ 376 61.3% $ 24,399 38.6%

Mid-Atlantic . . . . . . . . . . . . . . . . . . . . . . . 2,797 11.0 3,010 8.1 25 4.1 5,832 9.2

South . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,070 15.9 15,240 41.0 40 6.5 19,350 30.6

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,702 10.6 10,811 29.1 172 28.1 13,685 21.6

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 25,518 100.0% $ 37,135 100.0% $ 613 100.0% $ 63,266 100.0%

Internal risk rating:(3)

Noncriticized. . . . . . . . . . . . . . . . . . . . . . . $ 25,130 98.5% $ 34,008 91.6% $ 605 98.7% $ 59,743 94.4%

Criticized performing . . . . . . . . . . . . . . . . 350 1.4 1,662 4.5 3 0.5 2,015 3.2

Criticized nonperforming . . . . . . . . . . . . . 7 0.0 538 1.4 5 0.8 550 0.9

Acquired Loans(4) . . . . . . . . . . . . . . . . . . . 31 0.1 927 2.5 0 0.0 958 1.5

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 25,518 100.0% $ 37,135 100.0% $ 613 100.0% $ 63,266 100.0%