Capital One 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65 Capital One Financial Corporation (COF)

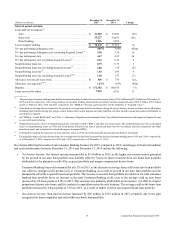

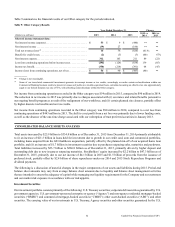

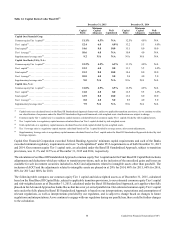

Deposits

Our deposits represent our largest source of funding for our operations, providing a consistent source of low-cost funds. Total

deposits increased by $12.2 billion to $217.7 billion as of December 31, 2015 from December 31, 2014. The increase in deposits

was primarily driven by the issuance of brokered deposits and growth in our Consumer Banking and Commercial Banking businesses

as a result of our continued focus on deposit relationships with existing customers and our ongoing marketing strategy to attract

new business from our commercial customers. We provide information on the composition of our deposits, average outstanding

balances, interest expense and yield below in “Liquidity Risk Profile.”

Securitized Debt Obligations

Securitized debt obligations increased by $4.5 billion to $16.2 billion as of December 31, 2015 from December 31, 2014 primarily

driven by debt issuances of approximately $5.1 billion, offset by debt maturities of $500 million during 2015. We provide additional

information on our borrowings below in “Liquidity Risk Profile.”

Other Debt

Other debt, which consists primarily of federal funds purchased and securities loaned or sold under agreements to repurchase,

senior and subordinated notes, and Federal Home Loan Banks (“FHLB”) advances, totaled $42.9 billion as of December 31, 2015,

of which $42.0 billion represented long-term debt and the remainder represented short-term borrowings. Other debt totaled $36.8

billion as of December 31, 2014, of which $17.1 billion represented short-term borrowings and $19.7 billion represented long-

term debt. During 2015, we extended the maturity of our FHLB advances which resulted in a decrease in our short-term borrowings

and a corresponding increase in our long-term debt.

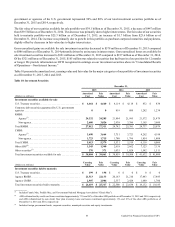

The increase in other debt of $6.1 billion in 2015 was primarily attributable to a net increase of $2.8 billion in FHLB advances,

$3.2 billion in unsecured senior notes and $101 million in federal funds purchased and securities loaned or sold under agreements

to repurchase. We provide additional information on our borrowings below in “Liquidity Risk Profile” and in “Note 10—Deposits

and Borrowings.”

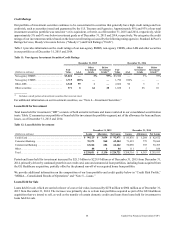

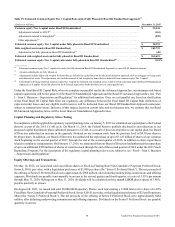

Mortgage Representation and Warranty Reserve

We acquired three subsidiaries that originated residential mortgage loans and sold these loans to various purchasers, including

purchasers who created securitization trusts. These subsidiaries are Capital One Home Loans, LLC, which was acquired in February

2005; GreenPoint, which was acquired in December 2006 as part of the North Fork Bancorporation, Inc. (“North Fork”) acquisition;

and CCB, which was acquired in February 2009 and subsequently merged into CONA.

We have established representation and warranty reserves for losses associated with the mortgage loans sold by each subsidiary

that we consider to be both probable and reasonably estimable, including both litigation and non-litigation liabilities. These reserves

are reported on our consolidated balance sheets as a component of other liabilities. The reserve setting process relies heavily on

estimates, which are inherently uncertain, and requires judgment. We evaluate these estimates on a quarterly basis. We build our

representation and warranty reserves through the provision for mortgage representation and warranty losses, which we report in

our consolidated statements of income as a component of non-interest income for loans originated and sold by CCB and Capital

One Home Loans, LLC and as a component of discontinued operations for loans originated and sold by GreenPoint. The aggregate

reserve for all three entities totaled $610 million as of December 31, 2015, compared to $731 million as of December 31, 2014.