Sallie Mae 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.87

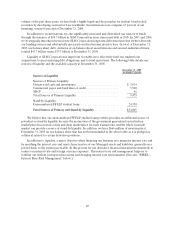

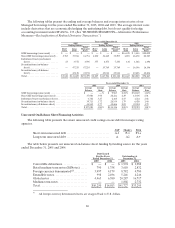

In addition to the term issuances reflected in the table above, we also use our commercial paper

program for short-term liquidity purposes. The average balance of commercial paper outstanding during

the years ended December 31, 2005 and 2004 was $345 million and $126 million, respectively. The

maximum daily amount outstanding for the years ended December 31, 2005 and 2004 was $2.8 billion and

$274 million, respectively.

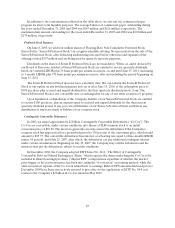

Preferred Stock Issuance

On June 8, 2005, we sold four million shares of Floating-Rate Non-Cumulative Preferred Stock,

Series B (the “Series B Preferred Stock”) in a registered public offering. Net proceeds from the sale of the

Series B Preferred Stock, after deducting underwriting fees and before other fees and expenses of the

offering, totaled $397 million and are being used for general corporate purposes.

Dividends on the shares of Series B Preferred Stock are not mandatory. When, as, and if declared by

our Board of Directors, holders of Series B Preferred Stock are entitled to receive quarterly dividends,

based on 3-month LIBOR plus 70 basis points per annum in arrears, on and until June 15, 2011, increasing

to 3-month LIBOR plus 170 basis points per annum in arrears, after and including the period beginning on

June 15, 2011.

The Series B Preferred Stock does not have a maturity date. We can redeem the Series B Preferred

Stock at our option on any dividend payment date on or after June 15, 2010, at the redemption price of

$100 per share plus accrued and unpaid dividends for the then quarterly dividend period, if any. The

Series B Preferred Stock is not convertible into or exchangeable for any of our other securities or property.

Upon liquidation or dissolution of the Company, holders of our Series B Preferred Stock are entitled

to receive $100 per share, plus an amount equal to accrued and unpaid dividends for the then current

quarterly dividend period, if any, pro rata with holders of our Series A Preferred Stock and before any

distribution of assets are made to holders of our common stock.

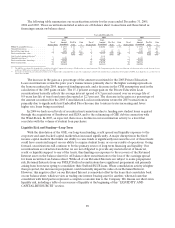

Contingently Convertible Debentures

In 2003, we issued approximately $2 billion Contingently Convertible Debentures (“Co-Cos”). The

Co-Cos are convertible, under certain conditions, into shares of SLM common stock at an initial

conversion price of $65.98. The investors generally can only convert the debentures if the Company’s

common stock has appreciated for a prescribed period to 130 percent of the conversion price, which would

amount to $85.77. The convertible debentures bear interest at a floating rate equal to three-month LIBOR

minus .05 percent, until July 25, 2007, after which, the debentures can pay additional contingent interest

under certain circumstances. Beginning on July 25, 2007, the Company may call the debentures and the

investors may put the debentures, subject to certain conditions.

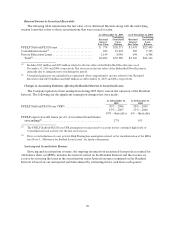

In December 2004, the Company adopted EITF Issue No. 04-8, “The Effect of Contingently

Convertible Debt on Diluted Earnings per Share,” which requires the shares underlying the Co-Cos to be

included in diluted earnings per share (“diluted EPS”) computations regardless of whether the market

price trigger or the conversion price has been met, using the “if-converted” accounting method, while the

after-tax interest expense of the Co-Cos is added back to earnings. Diluted EPS amounts disclosed prior to

December 2004 have been retroactively restated to give effect to the application of EITF No. 04-8 as it

relates to the Company’s $2 billion in Co-Cos issued in May 2003.