Sallie Mae 2005 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-22

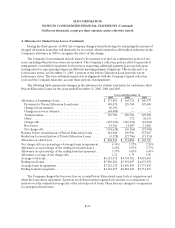

2. Significant Accounting Policies (Continued)

earnings for that period rather than being reported in an income statement. This statement is effective for

accounting changes made in fiscal years beginning after December 15, 2005. The Company adopted SFAS

No. 154 on January 1, 2006. The Company expects that the adoption of SFAS No. 154 will not have a

material impact on the Company’s financial statements.

Share-Based Payment

In December 2004, the FASB issued SFAS No. 123(R), “Share-Based Payment,” which is a revision of

SFAS No. 123, “Accounting for Stock-Based Compensation.” Generally, the approach in SFAS

No. 123(R) is similar to the approach described in SFAS No. 123. However, SFAS No. 123(R) requires all

share-based payments to employees, including grants of employee stock options, to be recognized in the

income statement based on their fair values. Pro forma disclosure is no longer an alternative. The new

standard will be effective for public entities (excluding small business issuers) for the fiscal year beginning

after June 15, 2005. The Company adopted SFAS No. 123(R) on January 1, 2006 using the modified-

prospective transition method. Had the Company adopted SFAS No. 123(R) for the year ended

December 31, 2005, its diluted earnings per share would have been $.08 lower, and going forward, the

Company expects that the adoption of SFAS No. 123(R) will have a similar effect on diluted earnings per

share.

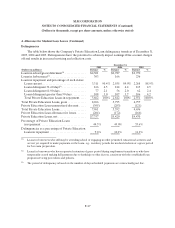

3. Student Loans

The FFELP is subject to comprehensive reauthorization every five years and to frequent statutory and

regulatory changes. The most recent reauthorization was the Higher Education Reconciliation Act of 2005

(the “Reauthorization Legislation”).

There are three principal categories of FFELP loans: Stafford loans, PLUS loans, and Consolidation

Loans. Generally, Stafford and PLUS loans have repayment periods of between five and ten years.

Consolidation Loans have repayment periods of twelve to thirty years. FFELP loans obligate the borrower

to pay interest at a stated fixed rate or a variable rate reset annually (subject to a cap) on July 1 of each

year depending on when the loan was originated and the loan type. The Company earns interest at the

greater of the borrower’s rate or a floating rate. If the floating rate exceeds the borrower rate, ED makes a

payment directly to the Company based upon the SAP formula. In low or certain declining interest rate

environments when student loans are earning at the fixed borrower rate, while the interest on the funding

for the loans is variable and declining, the Company can earn additional spread income that it refers to as

Floor Income.

As of December 31, 2005 and 2004, 60 percent and 63 percent, respectively, of the Company’s on-

balance sheet student loan portfolio was in repayment. Most of the Company’s loans do not require

repayment while the borrower is in-school and during the grace period immediately upon leaving school.

The borrower may also be granted a deferment or forbearance for a period of time based on need, during

which time the borrower is not considered to be in repayment. Interest continues to accrue on loans in

these in-school, grace, deferment and forbearance periods.

FFELP loans originated prior to October 1, 1993 are insured for 100 percent of their unpaid balance

against the borrower’s default, death, disability or bankruptcy. As of December 31, 2005, insurance on