Sallie Mae 2005 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-73

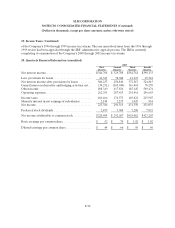

19. Income Taxes (Continued)

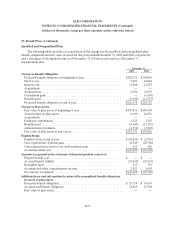

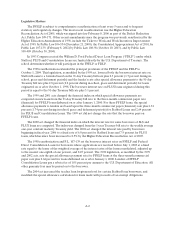

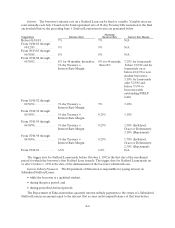

At December 31, 2005 and 2004, the tax effect of temporary differences that give rise to deferred tax

assets and liabilities include the following:

December 31,

2005 2004

Deferred tax assets:

Loanreserves.......................................................... $208,343 $138,305

Market valueadjustments on investments................................. 184,313 267,383

Deferred revenue...................................................... 138,102 10,238

Accrued expenses not currently deductible ................................ 61,780 57,983

Warrantsissuance...................................................... 49,448 57,081

Partnershipincome..................................................... 35,568 35,853

Loanoriginationservices................................................ 17,706 22,835

In-substance defeasancetransactions..................................... 4,718 24,117

Other................................................................. 30,259 60,873

Total deferred tax assets ................................................ 730,237 674,668

Deferred tax liabilities:

Unrealized investment gains recorded toother comprehensiveincome........ 197,834 238,396

Leases................................................................ 155,889 206,559

Securitization transactions............................................... 132,879 98,174

Depreciation/amortization .............................................. 51,987 87,335

Contingent payment and debt instruments................................. 78,934 62,006

Other................................................................. 10,128 8,297

Total deferred tax liabilities ............................................. 627,651 700,767

Net deferred tax assets/(liabilities)........................................ $102,586 $(26,099)

In the above table, unrealized investment gains recorded to other comprehensive income and market

adjustments on investments are separately stated. Historically, these items have been presented on a

combined basis.

Also included in the other deferred tax assets is a valuation allowance of $0 and $1,831 as of

December 31, 2005 and 2004, respectively, against the Company’s state deferred tax assets. The ultimate

realization of the deferred tax assets is dependent upon the generation of future taxable income during the

period in which the temporary differences become deductible. Management primarily considers the

scheduled reversals of deferred tax liabilities and the history of positive taxable income in making this

determination. During 2005, it was determined that the subsidiary with the valuation allowance now has

sufficient taxable income to realize the benefit of its deferred tax assets and the existing allowance was

released.

As of December 31, 2005, the Company has apportioned state net operating loss carryforwards of

$133,593 which begin to expire in 2006.

In 2004, the Company and the IRS reached an agreement with respect to the one outstanding issue

associated with the review of the Company’s 1994 and 1995 income tax returns. In addition, during 2004,

the Company and the IRS reached an agreement with regard to all but one issue associated with the review