Sallie Mae 2005 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-7

repayment begins or during any deferral periods. The Higher Education Act provides that the owner of an

eligible Subsidized Stafford Loan has a contractual right against the United States to receive interest

subsidy and special allowance payments. However, receipt of interest subsidy and special allowance

payments is conditioned on compliance with the requirements of the Higher Education Act.

Lenders generally receive interest subsidy and special allowance payments within 45 days to 60 days

after submitting the applicable data for any given calendar quarter to the Department of Education.

However, there can be no assurance that payments will, in fact, be received from the Department within

that period.

If the loan is not held by an eligible lender in accordance with the requirements of the Higher

Education Act and the applicable guarantee agreement, the loan may lose its federal assistance.

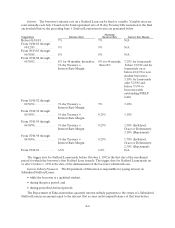

Loan Limits. The Higher Education Act generally requires that lenders disburse student loans in at

least two equal disbursements. The Act limits the amount a student can borrow in any academic year. The

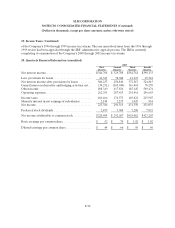

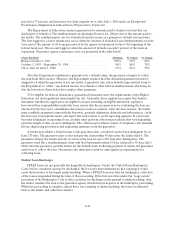

following chart shows current and historic loan limits.

Independent Students

Borrower’s Academic Level Base Amount Subsidized

and Unsubsidized On or After 10/1/93

Subsidized

On or After

1/1/87

All Students

Subsidized and

Unsubsidized On

or After 10/1/93

Additional

Unsubsidized

Only On or

After 7/1/94

Maximum Annual

Total Amount

Undergraduate (per year):

1styear .................................. $ 2,625 $ 2,625* $ 4,000 $ 6,625

2ndyear.................................. $ 2,625 $ 3,500* $ 4,000 $ 7,500

3rd year and above ........................ $ 4,000 $ 5,500 $ 5,000** $ 10,500

Graduate (per year) ....................... $ 7,500 $ 8,500 $10,000* $ 18,500

Aggregate Limit:

Undergraduate ........................... $ 17,250 $ 23,000 $ 23,000 $ 46,000

Graduate(includingundergraduate)......... $ 54,750 $ 65,500 $ 73,000 $ 138,500

For the purposes of the table above:

•The loan limits include both FFELP and FDLP loans.

•The amounts in the second column represent the combined maximum loan amount per year for

Subsidized and Unsubsidized Stafford Loans. Accordingly, the maximum amount that a student

may borrow under an Unsubsidized Stafford Loan is the difference between the combined

maximum loan amount and the amount the student received in the form of a Subsidized Stafford

Loan.

* Effective July 1, 2007, first and second year Stafford loan limits increase from $2,625 and $3,500 to

$3,500 and $4,500 respectively, and graduate and professional student unsubsidized Stafford loan

limits increase from $10,000 to $12,000.

** Effective July 1, 2007 the annual unsubsidized Stafford loan limit for students taking coursework

necessary for enrollment in a graduate or professional program is increased from $5,000 to $7,000.

Independent undergraduate students, graduate students and professional students may borrow the

additional amounts shown in the next to last column in the chart above. Dependent undergraduate

students may also receive these additional loan amounts if their parents are unable to provide the family

contribution amount and it is unlikely that they will qualify for a PLUS Loan.

•Students attending certain medical schools are eligible for higher annual and aggregate loan limits.

•The annual loan limits are sometimes reduced when the student is enrolled in a program of less

than one academic year or has less than a full academic year remaining in his program.