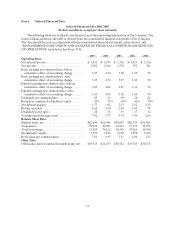

Sallie Mae 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS—LENDING BUSINESS SEGMENT—Total Loan Net Charge-offs.”) In addition, our

future charge-off rates could be materially impacted by downturns in the economy.

DEBT MANAGEMENT OPERATIONS BUSINESS SEGMENT

Our growth in our DMO business segment is dependent in part on successfully identifying, consummating and

integrating strategic acquisitions.

Since 2000, we have acquired five companies that are now successfully integrated within our Debt

Management Operations group. Each of these acquisitions has contributed to DMO’s substantial growth.

Future growth in the DMO group is dependent in part on successfully identifying, consummating and

integrating strategic acquisitions. There can be no assurance that we will be successful in doing so. In

addition, certain of these acquisitions have expanded our operations into businesses and asset classes that

pose substantially more business and litigation risks than our core FFELP student loan business. For

example, on September 16, 2004, we acquired a 64 percent (now 76 percent) interest in AFS Holdings,

LLC, commonly known as Arrow Financial Services, a company that, among other services, purchases non-

performing receivables. In addition, on August 30, 2005, we purchased GRP, a company that purchases

distressed mortgage receivables. While both companies purchase such assets at a discount and have

sophisticated analytical and operational tools to price and collect on portfolio purchases, there can be no

assurance that the price paid for defaulted portfolios will yield adequate returns, or that other factors

beyond their control will not have a material adverse affect on their results of operations. Portfolio

performance below original projections could result in impairments to the purchased portfolio assets. In

addition, these businesses are subject to litigation risk under the Fair Debt Collection Practices Act, Fair

Credit Reporting Act and various other federal, state and local laws in the normal course. Finally, we may

explore additional business opportunities that may pose further risks.

Our DMO group may not be able to purchase defaulted consumer receivables at prices that management believes

to be appropriate, and a decrease in our ability to purchase portfolios of receivables could adversely affect our net

income.

If our DMO group is not able to purchase defaulted consumer receivables at planned levels and at

prices that management believes to be appropriate, we could experience short-term and long-term

decreases in income.

The availability of receivables portfolios at prices which generate an appropriate return on our

investment depends on a number of factors both within and outside of our control, including the following:

•the continuation of current growth trends in the levels of consumer obligations;

•sales of receivables portfolios by debt owners;

•competitive factors affecting potential purchasers and credit originators of receivables; and

•the ability to continue to service portfolios to yield an adequate return.

Because of the length of time involved in collecting defaulted consumer receivables on acquired

portfolios and the volatility in the timing of our collections, we may not be able to identify trends and make

changes in our purchasing strategies in a timely manner.

LIQUIDITY AND CAPITAL RESOURCES

If our stock price falls significantly we may be required to settle our equity forward positions in a manner that

could have a materially dilutive effect on our common stock.

We regularly repurchase our common stock through both open market purchases and equity forward

contracts. At December 31, 2005, we had outstanding equity forward contracts to purchase 42.7 million

shares of our common stock at an average price of $54.74 per share. The equity forward contracts permit