Sallie Mae 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

impacted by the higher average balances of lower yielding short-term investments which were being built

up during 2004 as additional liquidity in anticipation of the GSE Wind-Down.

Student Loans

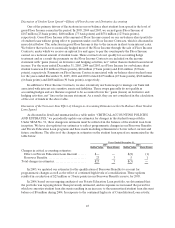

For both federally insured student loans and Private Education Loans, we account for premiums paid,

discounts received and certain origination costs incurred on the origination of student loans in accordance

with SFAS No. 91. The unamortized portion of the premiums and discounts are included in the carrying

value of the student loan on the consolidated balance sheet. We recognize income on our student loan

portfolio based on the expected yield of the student loan after giving effect to the amortization of purchase

premiums and the accretion of student loan discounts, as well as the discount expected to be earned

through Borrower Benefits programs. Discounts on Private Education Loans are deferred and accreted to

income over the lives of the student loans. In the table below, this accretion of discounts is netted with the

amortization of the premiums.

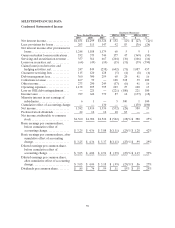

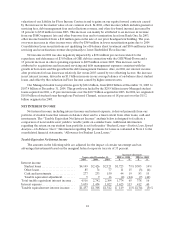

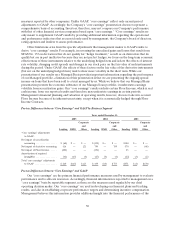

Student Loan Spread Analysis—On-Balance Sheet

The following table analyzes the reported earnings from student loans both on-balance sheet and

those off-balance sheet in securitization trusts. For student loans off-balance sheet, we will continue to

earn securitization and servicing fee revenues over the life of the securitized loan portfolios. The off-

balance sheet information is discussed in more detail in “LIQUIDITY AND CAPITAL RESOURCES—

Securitization Activities—Servicing and Securitization Revenue” where we analyze the on-going servicing

revenue and Residual Interest earned on the securitized portfolios of student loans. For an analysis of our

student loan spread for the entire portfolio of Managed student loans on a similar basis to the on-balance

sheet analysis, see “LENDING BUSINESS SEGMENT—Student Loan Spread Analysis—Managed Basis.”

Years ended December 31,

2005 2004 2003

On-Balance Sheet

Student loan yield, before Floor Income ......... 6.22% 4.53% 4.28 %

Gross FloorIncome........................... .25 .73 1.23

Consolidation Loan Rebate Fees ............... (.65) (.58) (.50 )

Offset Fees................................... — (.03) (.07 )

Borrower Benefits ............................ (.11) (.18) (.06 )

Premium anddiscount amortization............. (.16) (.13) (.18 )

Student loannet yield ......................... 5.55 4.34 4.70

Student loan cost offunds...................... (3.69) (2.01) (1.70 )

Student loan spread........................... 1.86% 2.33% 3.00 %

Off-Balance Sheet

Servicing and securitization revenue, before

Floor Income............................... .81% 1.17 % 1.27 %

Floor Income, net of Floor Income previously

recognized ingain on sale calculation.......... .06 .21 .47

Servicingand securitization revenue............. .87% 1.38% 1.74 %

Average Balances

On-balance sheet student loans ................. $ 74,724 $55,885 $ 45,127

Off-balance sheet student loans................. 41,220 40,558 38,205

Managed student loans........................ $115,944 $96,443 $ 83,332