Sallie Mae 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

volume of the past three years, we have built a highly liquid and deep market for student loan-backed

securities by developing an investor base worldwide. Securitizations now comprise 67 percent of our

financing, versus 66 percent at December 31, 2004.

In addition to securitizations, we also significantly increased and diversified our sources of funds

through the issuance of $10.3 billion in SLM Corporation term, unsecured debt in 2005. In 2003 and 2004,

we strategically introduced several new SLM Corporation long-term debt structures that further diversify

our funding sources and substantially increased our fixed income investor base. In total, at December 31,

2005, on-balance sheet debt, exclusive of on-balance sheet securitizations and secured indentured trusts,

totaled $41.7 billion versus $33.3 billion at December 31, 2004.

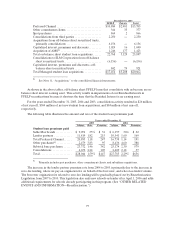

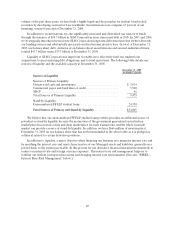

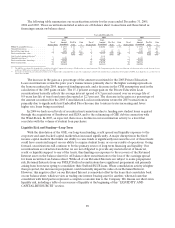

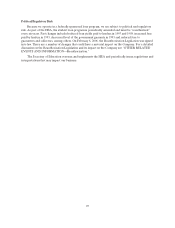

Liquidity at SLM Corporation is important to enable us to effectively fund our student loan

acquisitions, to meet maturing debt obligations, and to fund operations. The following table details our

sources of liquidity and the available capacity at December 31, 2005.

December 31, 2005

Available Capacity

Sources of Liquidity

Sources of Primary Liquidity:

Unrestricted cash and investments .............................. $ 3,934

Commercial paper and bank lines of credit ....................... 5,500

ABCP....................................................... 41

Total Sourcesof Primary Liquidity.............................. 9,475

Stand-by Liquidity:

Unencumbered FFELP student loans ........................... 24,530

Total Sources of Primary and Stand-by Liquidity ................. $ 34,005

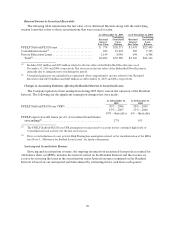

We believe that our unencumbered FFELP student loan portfolio provides an additional source of

potential or stand-by liquidity because the maturation of the government guaranteed securitization

marketplace has created a wide and deep marketplace for such transactions, and the whole loan sale

market can provide a source of stand-by liquidity. In addition, we have $666 million of investments at

December 31, 2005 on our balance sheet that has not been included in the above table as it is pledged as

collateral related to certain derivative positions.

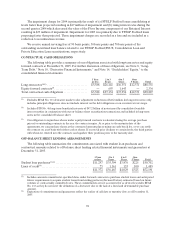

In addition to liquidity, a major objective when financing our business is to minimize interest rate risk

by matching the interest rate and reset characteristics of our Managed assets and liabilities, generally on a

pooled basis, to the extent practicable. In this process we use derivative financial instruments extensively to

reduce our interest rate and foreign currency exposure. This interest rate risk management helps us to

stabilize our student loan spread in various and changing interest rate environments. (See also “RISKS—

Interest Rate Risk Management” below.)