Sallie Mae 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

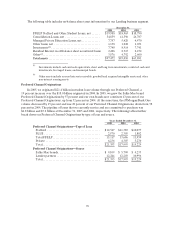

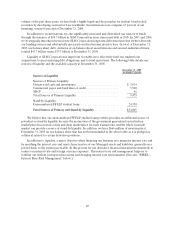

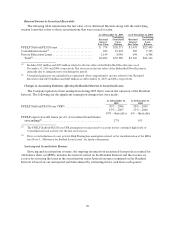

The following tables present the ending and average balances and average interest rates of our

Managed borrowings for the years ended December 31, 2005, 2004 and 2003. The average interest rates

include derivatives that are economically hedging the underlying debt, but do not qualify for hedge

accounting treatment under SFAS No. 133. (See “BUSINESS SEGMENTS—Alternative Performance

Measures—Reclassification of Realized Derivative Transactions.”)

Years ended December 31,

2005 2004 2003

Ending Balance Ending Balance Ending Balance

Short

Term Long

Term

Total

Managed

Basis Short

Term Long

Term

Total

Managed

Basis Short

Term Long

Term

Total

Managed

Basis

GSE borrowings (unsecured) ...... $ — $ — $ — $ — $ — $ — $ 16,678 $ 3,414 $ 20,092

Non-GSE borrowings (unsecured) . . 3,787 37,944 41,731 1,830 31,465 33,295 1,855 18,472 20,327

Indentured trusts (on-balance

sheet)....................... 23 3,372 3,395 377 6,873 7,250 134 1,362 1,496

Securitizations (on-balance

sheet)....................... — 47,235 47,235 — 35,769 35,769 — 16,346 16,346

Securitizations (off-balance

sheet)....................... — 43,138 43,138 — 43,814 43,814 — 40,606 40,606

Total......................... $3,810 $131,689 $135,499 $2,207 $117,921 $120,128 $18,667 $ 80,200 $ 98,867

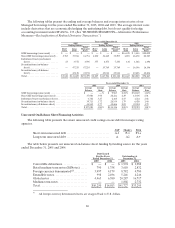

Years ended December 31,

2005 2004 2003

Average

Balance

Average

Rate

Average

Balance

Average

Rate

Average

Balance

Average

Rate

GSE borrowings (unsecured) ........................ $ — —% $ 9,967 2.21% $32,847 1.80%

Non-GSE borrowings (unsecured) .................... 37,980 3.98 28,241 2.29 13,305 2.01

Indentured trusts (on-balance sheet) .................. 4,782 3.27 2,168 2.47 1,221 2.68

Securitizations (on-balance sheet).................... 39,713 3.72 28,354 1.79 6,026 1.40

Securitizations (off-balance sheet).................... 44,545 3.77 42,606 2.09 39,524 1.79

Total........................................... $ 127,020 3.80% $ 111,336 2.08% $ 92,923 1.81%

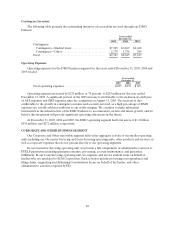

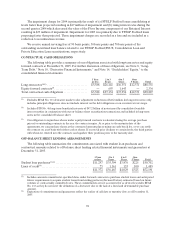

Unsecured On-Balance Sheet Financing Activities

The following table presents the senior unsecured credit ratings on our debt from major rating

agencies.

S&P Moody’s Fitch

Short-term unsecured debt............................... A-1 P-1 F1+

Long-term unsecured debt............................... A A2 A+

The table below presents our unsecured on-balance sheet funding by funding source for the years

ended December 31, 2005 and 2004.

Debt Issued

For the Years

Ended December 31,

Outstanding at

December 31,

2005 2004 2005 2004

Convertibledebentures.................. $ — $ — $ 1,992 $ 1,988

Retail medium-term notes (EdNotes) ..... 790 1,758 3,618 2,832

Foreign currency denominated(1).......... 3,997 4,179 8,782 4,780

Extendiblenotes........................ 998 2,496 5,246 4,246

Globalnotes ........................... 4,465 6,380 20,287 16,717

Medium-term notes ..................... — — 1,802 2,732

Total.................................. $10,250 $14,813 $41,727 $ 33,295

(1) All foreign currency denominated notes are swapped back to U.S. dollars.