Sallie Mae 2005 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-52

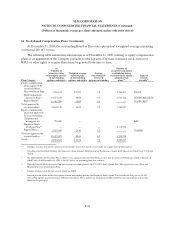

13. Commitments, Contingencies and Guarantees (Continued)

Contingencies

The Company was named as a defendant in a putative class action lawsuit brought by three Wisconsin

residents on December 20, 2001 in the Superior Court for the District of Columbia. The lawsuit sought to

bring a nationwide class action on behalf of all borrowers who allegedly paid “undisclosed improper and

excessive” late fees over the past three years. The plaintiffs sought damages of one thousand five hundred

dollars per violation plus punitive damages and claimed that the class consisted of two million borrowers.

In addition, the plaintiffs alleged that the Company charged excessive interest by capitalizing interest

quarterly in violation of the promissory note. On February 27, 2003, the Superior Court granted the

Company’s motion to dismiss the complaint in its entirety. On March 4, 2004, the District of Columbia

Court of Appeals affirmed the Superior Court’s decision granting the Company’s motion to dismiss the

complaint, but granted plaintiffs leave to re-plead the first count, which alleged violations of the D.C.

Consumer Protection Procedures Act. On September 15, 2004, the plaintiffs filed an amended class action

complaint. On October 15, 2004, the Company filed a motion to dismiss the amended complaint with the

Superior Court for failure to state a claim and non-compliance with the Court of Appeals’ ruling. On

December 27, 2004, the Superior Court granted the Company’s motion to dismiss the plaintiffs’ amended

compliant. Plaintiffs have appealed the Superior Court’s December 27, 2004 dismissal order to the Court

of Appeals. The Court of Appeals heard oral argument on January 11, 2006. Even if the Court of Appeals

reverses the dismissal order, the Company does not believe that it is reasonably likely that the Court would

certify a nationwide class.

The Company is also subject to various claims, lawsuits and other actions that arise in the normal

course of business. Most of these matters are claims by borrowers disputing the manner in which their

loans have been processed or the accuracy of the Company’s reports to credit bureaus. In addition, the

collections subsidiaries in the Company’s debt management operation group are occasionally named in

individual plaintiff or class action lawsuits in which the plaintiffs allege that the Company has violated a

federal or state law in the process of collecting their account. Management believes that these claims,

lawsuits and other actions will not have a material adverse effect on its business, financial condition or

results of operations.

14. Stockholders’ Equity

Preferred Stock

At December 31, 2005, the Company had 3.3 million shares of 6.97 percent Cumulative Redeemable

Preferred Stock, Series A (the “Series A Preferred Stock”) outstanding. The shares do not have any

maturity date but can be redeemed at the Company’s option, beginning November 16, 2009, at the

redemption price of $50 plus accrued and unpaid dividends up to the redemption date. The shares have no

preemptive or conversion rights. Dividends on the shares of the Series A Preferred Stock are not

mandatory. Holders of the Series A Preferred Stock are entitled to receive cumulative, quarterly cash

dividends at the annual rate of $3.485 per share, when, as, and if declared by the Board of Directors of the

Company. For each of the years ended December 31, 2005, 2004 and 2003, dividends paid on Series A

Preferred Stock reduced net income by $11.5 million.