Sallie Mae 2005 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-25

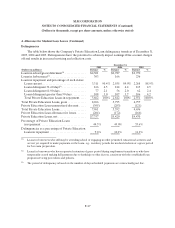

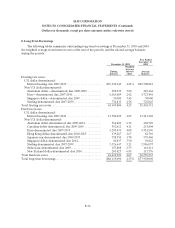

4. Allowance for Student Loan Losses (Continued)

In addition to the provisions for student loan losses, provisions for other losses totaled $15 million,

$11 million, and $5 million for the years ended December 31, 2005, 2004, and 2003, respectively.

Allowance for FFELP Student Loan Losses

On February 8, 2006, the Reauthorization Legislation was signed into law. The legislation reduces the

level of default insurance to 97 percent from 98 percent (effectively increasing Risk Sharing from two

percent to three percent) on loans disbursed after July 1, 2006 for lenders without EP designation.

Furthermore, the Reauthorization Legislation reduces the default insurance paid to lenders/servicers with

the EP designation to 99 percent from 100 percent on claims filed after July 1, 2006. In response to this

decrease in insurance levels, the Company established a $10 million Risk-Sharing allowance as of

December 31, 2005 for an estimate of losses on FFELP Student Loans based on the one percent reduction

in default insurance for servicers with the EP designation.

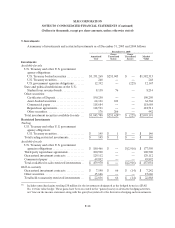

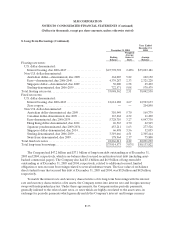

Allowance for Private Education Loan Losses

The Company’s allowance for Private Education Loan losses is an estimate of losses in the portfolio at

the balance sheet date that will be charged off in subsequent periods. The maturing of the Company’s

Private Education Loan portfolios has provided more historical data on borrower default behavior such

that those portfolios can now be analyzed to determine the effects that the various stages of delinquency

have on borrower default behavior and ultimate charge-off. As a result, in the second quarter of 2005, the

Company’s estimate of the allowance for loan losses was changed to include a migration analysis of

delinquent and current accounts, in addition to other considerations. A migration analysis is a technique

used to estimate the likelihood that a loan receivable may progress through the various delinquency stages

and ultimately charge off, and is a widely used reserving methodology in the consumer finance industry.

Previously, the Company calculated its allowance for Private Education Loan losses by estimating the

probable losses in the portfolio based primarily on loan characteristics and where pools of loans were in

their life with less emphasis on current delinquency status of the loan. Also, in the prior methodology for

calculating the allowance, some loss rates were based on proxies and extrapolations of FFELP loan loss

data.

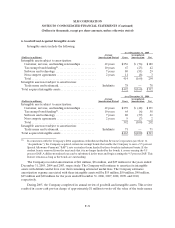

The Company also transitioned to a migration analysis to revise its estimates pertaining to its non-

accrual policy for interest income. Under this methodology, the amount of uncollectible accrued interest

on Private Education Loans is estimated and written off against current period interest income. Under the

Company’s prior methodology, Private Education Loans continued to accrue interest, including in periods

of forbearance, until they were charged off, at which time, the loans were placed on non-accrual status and

all previously accrued interest was reversed against income in the month of charge-off. The allowance for

loan losses provided for a portion of the probable losses in accrued interest receivable prior to charge-off.

This change in reserving methodology has been accounted for as a change in estimate in accordance

with APB Opinion No. 20, “Accounting Changes.” The effect of this change was to increase the allowance

by $40 million and to reduce student loan interest income for the estimate of uncollectible accrued interest

receivable by $14 million. On the income statement, adjustments to the allowance are recorded through

the provisions for loan losses whereas adjustments to accrued interest are recorded in interest income.