Sallie Mae 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

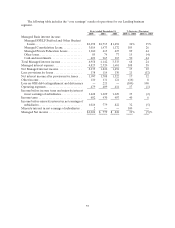

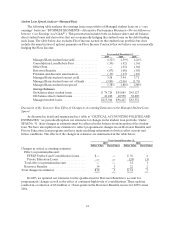

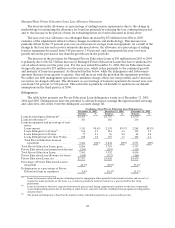

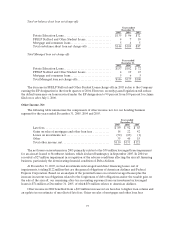

Student Loan Floor Income Contracts

The following table analyzes the ability of the FFELP student loans in our Managed student loan

portfolio to earn Floor Income after December 31, 2005 and 2004.

December 31, 2005 December 31, 2004

(Dollars in billions)

Fixed

borrower

Rate

Variable

borrower

rate Total

Fixed

borrower

Rate

Variable

borrower

rate Total

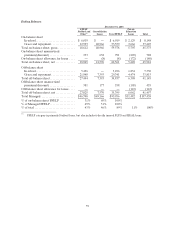

Student loans eligible to earn Floor Income:

On-balance sheet student loans ............... $ 53.4 $16.0 $ 69.4 $ 40.5 $14.0 $ 54.5

Off-balance sheet student loans ............... 10.3 18.4 28.7 7.4 24.6 32.0

Managed student loans eligible to earn Floor

Income .................................... 63.7 34.4 98.1 47.9 38.6 86.5

Less: notional amount of floor swap/debt contracts — — — (1.2 ) — (1.2)

Less: notional amount of Floor Income Contracts . (25.1) — (25.1) (26.6 ) — (26.6)

Total economically hedged Floor Income

Contracts ................................ (25.1) — (25.1) (27.8 ) — (27.8)

Net Managed student loans eligible to earn Floor

Income .................................... $ 38.6 $34.4 $ 73.0 $ 20.1 $38.6 $ 58.7

Net Managed student loans earning Floor Income. $ 0.8 $ — $ 0.8 $ 2.4 $ — $ 2.4

The reconsolidation of Consolidation Loans has had an impact on the Floor Income Contracts

economically hedging the fixed borrower interest rate earned on Consolidation Loans. All Consolidation

Loans are eligible to earn Floor Income, and over time we have sold Floor Income Contracts to hedge the

potential Floor Income from specifically identified Consolidation Loans. The sale of the Floor Income

Contracts did not anticipate the reconsolidation of Consolidation Loans and as a consequence we are

losing higher rate Consolidation Loans that underlie the contracts. As a result, as of December 31, 2005,

the notional amount of Floor Income Contracts roughly equals the outstanding balance of the

Consolidation Loans that the Floor Income Contracts were sold against. Recently passed legislation

discontinues reconsolidation June 30, 2006, although there is a chance it may be ended sooner. Since we

are at parity between the loans and contracts at December 31, 2005, loans reconsolidating in 2006 would

potentially put us in an oversold position during 2006 related to our Floor Income Contracts. However, we

do not believe that the volume of reconsolidation will create a material oversold position vis-à-vis the

$25 billion of Consolidation Loans now hedged by Floor Income Contracts at December 31, 2005.

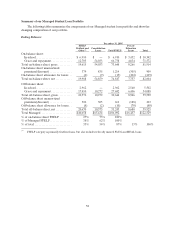

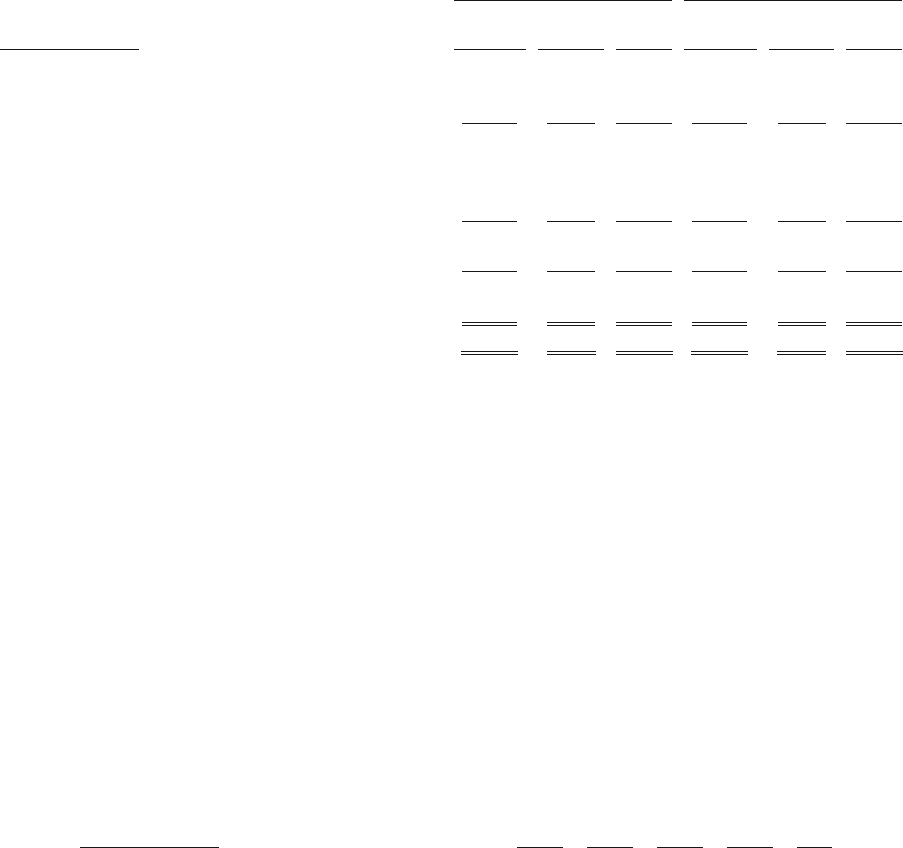

The following table presents a projection of the average Managed balance of Consolidation Loans

whose Fixed Rate Floor Income has already been economically hedged through Floor Income Contracts

for the period January 1, 2006 to March 31, 2010. These loans are both on and off-balance sheet and the

related hedges do not qualify under SFAS No. 133 accounting as effective hedges.

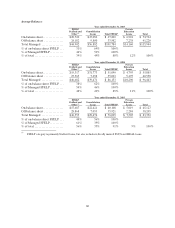

(Dollars in billions) 2006 2007 2008 2009 2010

Average balance of Consolidation Loans whose

Floor Income is economically hedged

(Managed Basis)......................... $ 25 $ 16 $ 15 $ 10 $ 2