Sallie Mae 2005 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-49

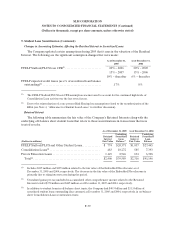

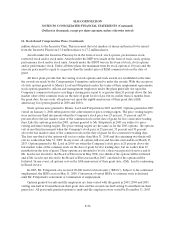

11. Acquisitions (Continued)

of SLFA, and all of the outstanding voting common stock for a 2 percent equity interest and an option to

purchase the remaining equity within six to eight months in Idaho Transferee Corporation (“ITC”), an

indirect subsidiary of SLFA. On July 1, 2005, the Company exercised the options to purchase the

remaining interests in WTC and ITC in the second step of this transaction. In a related transaction in

December 2004, NELA became an affiliate of USA Funds, the Company’s largest guarantor servicing

client.

The results of operations of WTC and ITC have been included in the Company’s consolidated

financial statements since the acquisition dates, December 15, 2004 and July 1, 2005, respectively, and are

reflected within the financial results of the Company’s Lending operating segment as discussed further in

Note 18, “Segment Reporting.” The acquisitions and the acquired businesses’ pro forma results of

operations prior to the acquisition dates were deemed immaterial to the Company’s consolidated financial

statements.

The Company finalized its purchase price allocation associated with these transactions in 2005,

allocating the purchase price to the fair values of the acquired intangible assets, liabilities and identifiable

intangible assets as of the acquisition date as determined by an independent appraiser. The purchase price

allocation resulted in an excess purchase price over the fair value of net assets acquired, or goodwill, in

aggregate, of approximately $7 million. Goodwill will be reviewed for impairment in accordance with SFAS

No. 142 as discussed further in Note 2, “Significant Accounting Policies.”

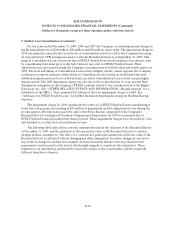

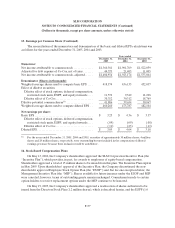

12. Fair Values of Financial Instruments

SFAS No. 107, “Disclosures about Fair Value of Financial Instruments,” requires the estimation of

the fair values of financial instruments. The following is a summary of the assumptions and methods used

to estimate those values.

Student Loans

For both FFELP loans and Private Education Loans, fair value is determined by modeling loan level

cash flows using market-based assumptions to determine aggregate portfolio yield, net present value and

average life. The FFELP loan valuations also include an analysis of the Floor Income element.

Other Loans

The fair values of academic facilities financings and other loans were determined through standard

bond pricing formulas using current market interest rates and credit spreads and quotes from third parties.

Cash and Investments (Including “Restricted”)

For investments with remaining maturities of three months or less, carrying value approximated fair

value. Investments in U.S. Treasury backed securities were valued at market quotations. All other

investments were valued through standard bond pricing formulas using current market interest rates and

credit spreads.