Sallie Mae 2005 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

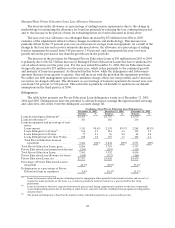

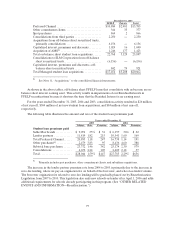

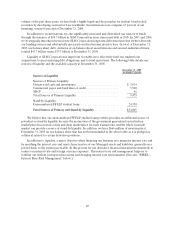

The following table includes on-balance sheet asset information for our Lending business segment.

December 31,

2005 2004 2003

FFELP Stafford and Other Student Loans, net ...... $19,

988 $ 18,965 $ 18,790

Consolidation Loans, net ......................... 54,859 41,596 26,787

Managed Private Education Loans,net............. 7,757 5,420 4,470

Otherloans,net ................................. 1,138 1,048 1,031

Investments(1) ................................... 7,748 8,914 7,741

Residual Interest in off-balance sheet securitized loans 2,406 2,315 2,472

Other(2)......................................... 3,576 4,792 2,600

Total assets ..................................... $ 97,472 $ 83,050 $ 63,891

(1) Investments include cash and cash equivalents, short and long term investments, restricted cash and

investments, leveraged leases, and municipal bonds.

(2) Other assets include accrued interest receivable, goodwill and acquired intangible assets and other

non-interest earning assets.

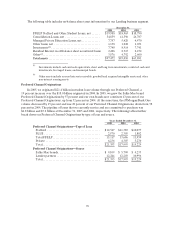

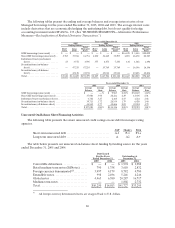

Preferred Channel Originations

In 2005, we originated $21.4 billion in student loan volume through our Preferred Channel, a

19 percent increase over the $18.0 billion originated in 2004. In 2005, we grew the Sallie Mae brand

Preferred Channel Originations by 57 percent and our own brands now constitute 43 percent of our

Preferred Channel Originations, up from 32 percent in 2004. At the same time, the JPMorgan/Bank One

volume decreased by 15 percent and was 28 percent of our Preferred Channel Originations, down from 38

percent in 2004. The pipeline of loans that we currently service and are committed to purchase was

$6.8 billion and $7.2 billion at December 31, 2005 and 2004, respectively. The following tables further

break down our Preferred Channel Originations by type of loan and source.

Years Ended December 31,

2005 2004 2003

Preferred Channel Originations—Type of Loan

Stafford ...................................... $12,547 $11,383 $ 10,077

PLUS ........................................ 2,570 2,303 1,882

TotalFFELP.................................. 15,117 13,686 11,959

Private ....................................... 6,236 4,307 3,270

Total......................................... $21,353 $17,993 $ 15,229

Preferred Channel Originations—Source

Sallie Mae brands.............................. $ 9,109 $ 5,790 $ 4,233

Lender partners ............................... 12,244 12,203 10,996

Total......................................... $21,353 $17,993 $ 15,229