Sallie Mae 2005 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214

|

|

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-28

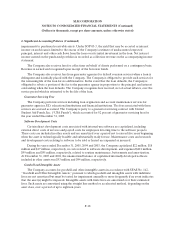

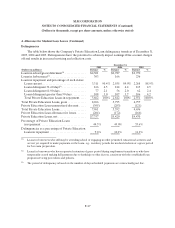

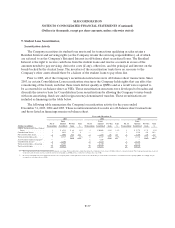

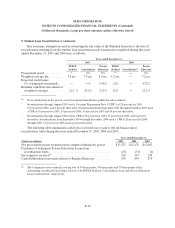

5. Investments

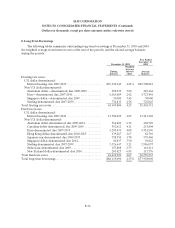

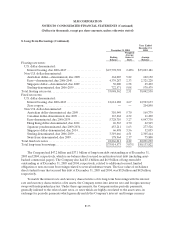

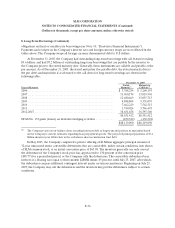

A summary of investments and restricted investments as of December 31, 2005 and 2004 follows:

December 31, 2005

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Market

Value

Investments

A

vailable-for-sale

U.S. Treasury and other U.S. government

agency obligations:

U.S.Treasurybackedsecurities............. $ 1,331,268 $ 251,045 $ — $ 1,582,313

U.S.Treasurysecurities.................... 248 — — 248

U.S. government agencies obligations........ 12,392 — (225) 12,167

State and political subdivisions of the U.S.:

Student loan revenuebonds................ 8,138 76 — 8,214

Other securities:

Certificates of Deposit..................... 190,250 — — 190,250

Asset-backedsecurities.................... 64,121 241 — 64,362

Commercial paper ........................ 118,684 — — 118,684

Repurchaseagreements.................... 118,511 — — 118,511

Othersecurities........................... 176 266 — 442

Total investment securities available-for-sale . . . $1,843,788 $251,628(1) $ (225 ) $ 2,095,191

Restricted Investments

Trading

U.S. Treasury and other U.S. government

agency obligations:

U.S.Treasurysecurities.................... $ 145 $ 1 $ — $ 146

Total tradingrestricted investments ........... $ 145 $ 1 $ — $ 146

A

vailable-for sale

U.S. Treasury and other U.S. government

agenciesobligations....................... $ 180,466 $ — $ (2,916) $ 177,550

Third party repurchase agreements............ 100,500 — — 100,500

Guaranteed investment contracts ............. 129,112 — — 129,112

Commercial paper .......................... 49,892 — — 49,892

Total available-for-sale restricted investments . . $ 459,970 $ — $ (2,916) $ 457,054

Held-to-maturity

Guaranteed investment contracts ............. $ 7,190 $ 66 $ (14) $ 7,242

Othersecurities............................. 15,646 — — 15,646

Total held-to-maturity restricted investments . . . $ 22,836 $ 66 $ (14) $ 22,888

(1) Includes unrealized gains totaling $38 million for the investments designated as the hedged items in a SFAS

No. 133 fair value hedge. These gains have been recorded in the “gains (losses) on derivative hedging activities,

net” line on the income statement along with the gain (loss) related to the derivatives hedging such investments.