Sallie Mae 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

decreased by $4 million from 2004 to 2005 and by $20 million from 2003 to 2004. These decreases were

primarily due to higher interest rates causing a slowdown in mortgage refinancings over the last two years.

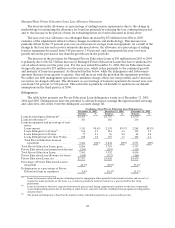

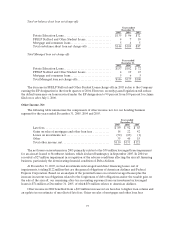

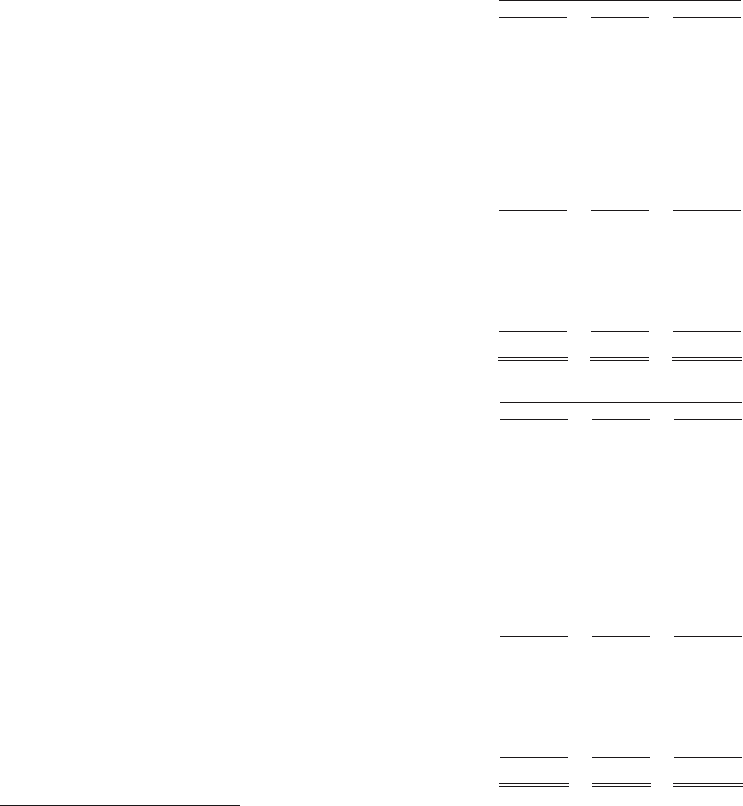

Student Loan Acquisitions

In 2005, 75 percent of our Managed student loan acquisitions (exclusive of loans acquired through

business acquisitions and capitalized interest, premiums and discounts) were originated through our

Preferred Channel. The following tables summarize the components of our student loan acquisition

activity for the years ended December 31, 2005, 2004 and 2003.

December 31, 2005

FFELP Private Total

PreferredChannel................................ $14,847 $6,046 $ 20,893

Other commitment clients ......................... 500 56 556

Spot purchases ................................... 1,880 — 1,880

Consolidations from third parties................... 4,671 1 4,672

Acquisitions from off-balance sheet securitized trusts,

primarily consolidations ......................... 9,487 — 9,487

Acquisition of Idaho Transferee Corporation(1) ....... 43 — 43

Capitalized interest, premiums and discounts ......... 1,364 (10) 1,354

Total on-balance sheet student loan acquisitions ...... 32,792 6,093 38,885

Consolidations to SLM Corporation from off-balance

sheet securitized trusts........................... (9,487) — (9,487 )

Capitalized interest, premiums and discounts—off-

balance sheetsecuritized trusts................... 533 275 808

Total Managed student loan acquisitions............. $23,838 $6,368 $ 30,206

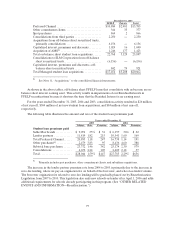

December 31, 2004

FFELP Private Total

PreferredChannel................................ $12,756 $3,982 $ 16,738

Other commitment clients ......................... 368 45 413

Spot purchases ................................... 1,804 4 1,808

Consolidations from third parties................... 2,609 — 2,609

Acquisitions from off-balance sheet securitized trusts,

primarily consolidations ......................... 5,554 — 5,554

Acquisition of Southwest(1) ......................... 4,776 4 4,780

Acquisition of SLFA(1) ............................. 1,435 — 1,435

Capitalized interest, premiums and discounts ......... 1,398 (2) 1,396

Total on-balance sheet student loan acquisitions ...... 30,700 4,033 34,733

Consolidations to SLM Corporation from off-balance

sheet securitized trusts........................... (5,554) — (5,554 )

Capitalized interest, premiums and discounts—off-

balance sheetsecuritized trusts................... 565 172 737

Total Managed student loan acquisitions............. $25,711 $4,205 $ 29,916

(1) See Note 11, “Acquisitions,” to the consolidated financial statements.