Sallie Mae 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

may be applied. We regularly update our probability assessment related to such forecasted debt issuances.

This assessment includes analyzing prior debt issuances and assessing changes in our future funding

strategies.

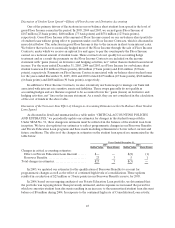

SFAS No. 133 requires that changes in the fair value of derivative instruments be recognized currently

in earnings unless specific hedge accounting criteria as specified by SFAS No. 133 are met. We believe that

all of our derivatives are effective economic hedges and are a critical element of our interest rate risk

management strategy. However, under SFAS No. 133, some of our derivatives, primarily Floor Income

Contracts, certain Eurodollar futures contracts, basis swaps and equity forwards, do not qualify for “hedge

treatment” under SFAS No. 133. Therefore, changes in market value along with the periodic net

settlements must be recorded through the “gains (losses) on derivative and hedging activities, net” line in

the income statement with no consideration for the corresponding change in fair value of the hedged item.

The derivative market value adjustment is primarily caused by interest rate volatility, changing credit

spreads during the period, and changes in our stock price (related to equity forwards) and the volume and

term of derivatives not receiving hedge accounting treatment. See also “BUSINESS SEGMENTS—

Alternative Performance Measures—Pre-tax Differences between “Core Earnings” and GAAP—Derivative

Accounting” for a detailed discussion of our accounting for derivatives.

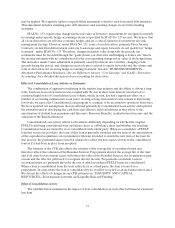

Effects of Consolidation Loan Activity on Estimates

The combination of aggressive marketing in the student loan industry and the ability to obtain a long-

term, fixed rate loan at low interest rates coupled with the rise in short-term interest rates has led to

continued high levels of Consolidation Loan volume, which, in turn, has had a significant effect on a

number of accounting estimates in recent years. As long as long-term interest rates remain at historically

low levels, we expect the Consolidation Loan program to continue to be an attractive option for borrowers.

We have updated our assumptions that are affected primarily by Consolidation Loan activity and updated

the estimates used in developing the cash flows and effective yield calculations as they relate to the

amortization of student loan premiums and discounts, Borrower Benefits, residual interest income and the

valuation of the Residual Interest.

Consolidation Loan activity affects each estimate differently depending on whether the original

FFELP loans being consolidated were on-balance sheet or off-balance sheet and whether the resulting

Consolidation Loan is retained by us or consolidated with a third party. When we consolidate a FFELP

loan that was in our portfolio, the term of that loan is generally extended and the term of the amortization

of the capitalized acquisition costs (premium) is likewise extended to match the new term of the loan. In

that process, the premium balance must be adjusted to reflect the new expected term of the consolidated

loan as if it had been in place from inception.

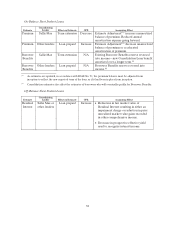

The estimate of the CPR also affects the estimate of the average life of securitized trusts and

therefore affects the valuation of the Residual Interest. Prepayments shorten the average life of the trust,

and if all other factors remain equal, will reduce the value of the Residual Interest, the securitization gain

on sale and the effective yield used to recognize interest income. Prepayments on student loans in

securitized trusts are primarily driven by the rate at which securitized FFELP loans are consolidated.

When a loan is consolidated from the trust either by us or a third party, the loan is treated as a

prepayment. In cases where the loan is consolidated by us, it will be recorded as an on-balance sheet asset.

We discuss the effects of changes in our CPR estimates in “LIQUIDITY AND CAPITAL

RESOURCES—Securitization Activities and Liquidity Risk and Funding.”

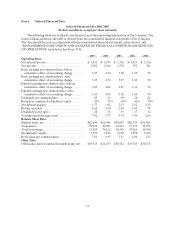

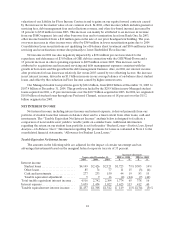

Effect of Consolidation Activity

The schedule below summarizes the impact of loan consolidation on each affected financial statement

line item.