Sallie Mae 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

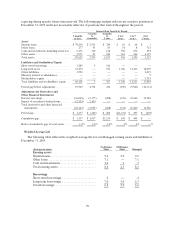

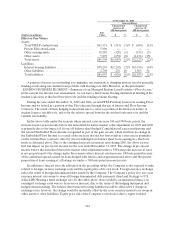

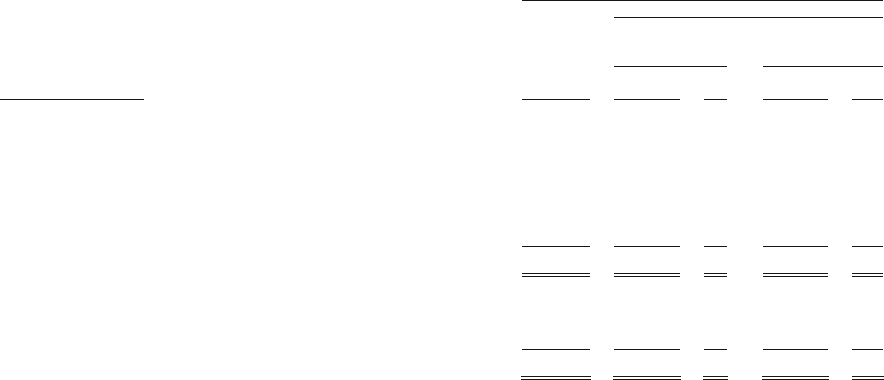

At December 31, 2004

Interest Rates:

Change from

increase of

100 basis points

Change from

increase of

300 basis points

(Dollars in millions)

Fair

Value $ % $ %

Effect on Fair Values

Assets

Total FFELPstudent loans......................... $61,531 $ (315) (1)% $ (636) (1)%

Private Education Loans........................... 5,900 — — — —

Other earning assets............................... 10,285 (120) (1) (333) (3)

Other assets...................................... 7,878 (652) (8) (1,154) (15)

Total assets....................................... $85,594 $ (1,087) (1)% $ (2,123) (2)%

Liabilities

Interest bearing liabilities .......................... $78,295 $ (1,202) (2)% $ (3,356) (4)%

Other liabilities................................... 2,798 276 10 1,503 54

Total liabilities.................................... $81,093 $ (926) (1)% $ (1,853) (2)%

A primary objective in our funding is to minimize our sensitivity to changing interest rates by generally

funding our floating rate student loan portfolio with floating rate debt. However, as discussed under

“LENDING BUSINESS SEGMENT—Summary of our Managed Student Loan Portfolio—Floor Income,”

in the current low interest rate environment, we can have a fixed versus floating mismatch in funding if the

student loan earns at the fixed borrower rate and the funding remains floating.

During the year ended December 31, 2005 and 2004, certain FFELP student loans were earning Floor

Income and we locked in a portion of that Floor Income through the use of futures and Floor Income

Contracts. The result of these hedging transactions was to convert a portion of the fixed rate nature of

student loans to variable rate, and to fix the relative spread between the student loan asset rate and the

variable rate liability.

In the above table under the scenario where interest rates increase 100 and 300 basis points, the

increase in pre-tax net income before the unrealized derivative market value adjustment for 2005 and 2004

is primarily due to the impact of (i) our off-balance sheet hedged Consolidation Loan securitizations and

the related Embedded Floor Income recognized as part of the gain on sale, which results in no change in

the Embedded Floor Income as a result of the increase in rates but does result in a decrease in payments

on the written Floor contracts; offset by (ii) our unhedged on-balance sheet loans earning in a fixed rate

mode as discussed above. Due to the continued increase in interest rates during 2005, the above factors

had less impact on pre-tax net income for the year ended December 31, 2005. The change in pre-tax net

income before the unrealized derivative market value adjustment under a 300 basis point increase in rates

is not proportional to the change under the scenario where interest rates increase 100 basis points because

of the additional spread earned on loans hedged with futures and swaps mentioned above and the greater

proportion of loans earning at a floating rate under a 300 basis point increase in rates.

In addition to interest rate risk addressed in the preceding tables, the Company is also exposed to risks

related to foreign currency exchange rates and the equity price of its own stock. Foreign currency exchange

risk is the result of foreign denominated debt issued by the Company. The Company’s policy is to use cross

currency interest rate swaps to swap all foreign denominated debt payments (fixed and floating) to U.S.

dollar LIBOR using a fixed exchange rate. In the tables above, there would be an immaterial impact on

earnings if exchange rates were to decrease or increase, due to the terms of the hedging instrument and

hedged items matching. The balance sheet interest bearing liabilities would be affected by a change in

exchange rates, however, the change would be materially offset by the cross currency interest rate swaps in

other assets or other liabilities. Equity price risk of the Company’s own stock is due to equity forward