Sallie Mae 2005 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-33

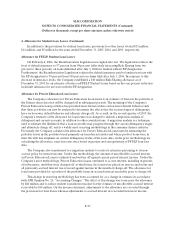

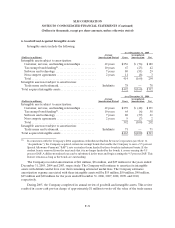

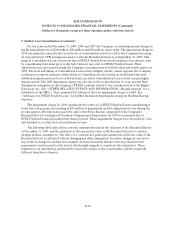

7. Short-Term Borrowings

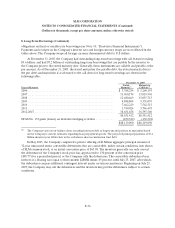

Short-term borrowings have a remaining term to maturity of one year or less. The following tables

summarize outstanding short-term borrowings at December 31, 2005 and 2004, the weighted average

stated interest rates at the end of each period, and the related average balances and weighted average

stated interest rates during the periods.

December 31, 2005

Year ended

December 31, 2005

Ending

Balance

Weighted

Average

Interest

Rate

Average

Balance

Weighted

Average

Interest

Rate

Short-termdeposits................................. $ 1,000 4.66% $ 8 4.36%

Floating ratenotes ................................. 3,367 4.16 161,549 2.80

Commercial paper.................................. — — 345,236 3.10

Short-term portionof long-term borrowings........... 3,805,288 4.36 4,010,259 3.49

Total short-term borrowings ......................... $ 3,809,655 4.36% $ 4,517,052 3.43%

Maximum outstanding at any month end.............. $ 5,516,177

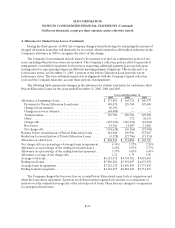

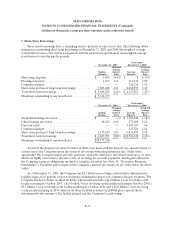

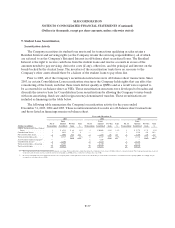

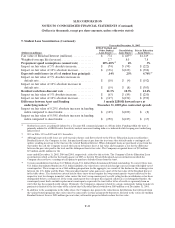

December 31, 2004

Year ended

December 31, 2004

Ending

Balance

Weighted

Average

Interest

Rate

Average

Balance

Weighted

Average

Interest

Rate

Six month floating rate notes ........................ $ — —% $ 1,585,830 1.18%

Other floating rate notes............................ 29,256 4.96 373,888 1.22

Discount notes..................................... — — 1,687,391 .96

Commercial paper.................................. — — 125,224 1.86

Short-term portionof long-term borrowings........... 2,177,839 2.83 6,824,097 3.18

Total short-term borrowings ......................... $ 2,207,095 2.86% $10,596,430 2.44%

Maximum outstanding at any month end.............. $20,177,348

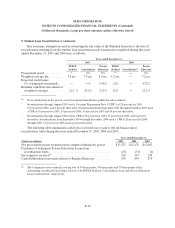

To match the interest rate characteristics of short-term notes with the interest rate characteristics of

certain assets, the Company enters into interest rate swaps with independent parties. Under these

agreements, the Company makes periodic payments, generally indexed to the related asset rates, or rates

which are highly correlated to the asset rates, in exchange for periodic payments, which generally match

the Company’s interest obligations on fixed or variable rate notes (see Note 10, “Derivative Financial

Instruments”). Payments and receipts on the Company’s interest rate swaps are not reflected in the above

tables.

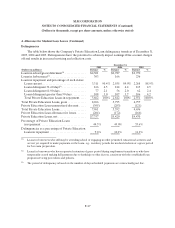

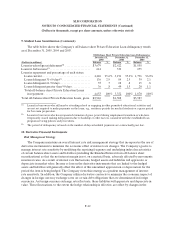

As of December 31, 2005, the Company has $5.5 billion in revolving credit facilities which provide

liquidity support for general corporate purposes including backup for its commercial paper program. The

Company has never drawn on these facilities. The facilities include a $1.0 billion 5-year revolving credit

facility maturing in October 2007, a $1.0 billion 5-year revolving credit facility maturing in October 2008, a

$1.5 billion 5-year revolving credit facility maturing in October 2009, and a $2.0 billion 5-year revolving

credit facility maturing in 2010. Interest on these facilities is based on LIBOR plus a spread that is

determined by the amount of the facility utilized and the Company’s credit rating.