Sallie Mae 2005 Annual Report Download - page 135

Download and view the complete annual report

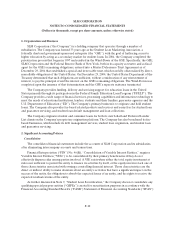

Please find page 135 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-13

2. Significant Accounting Policies (Continued)

Reconciliation Act of 2005 (the “HEA”) which was signed into law on February 8, 2006. Prior to being

designated as an EP, the Company was subject to the two percent Risk Sharing on these loans. The

Company is entitled to receive this benefit as long as it remains in compliance with the required servicing

standards, which are assessed on an annual and quarterly basis through compliance audits and other

criteria. The EP designation also applies to all FFELP loans that the Company owns but are serviced by

other service providers with the EP designation and conversely does not apply for loans serviced by other

service providers without the EP designation. As a result of the amended reimbursement level through the

HEA reauthorization, the Company established an allowance at December 31, 2005 for loans that will be

subject to the one percent Risk Sharing provision. When calculating this allowance, the Company

considers trends in student loan claims rejected for payment by guarantors based on periodic evaluations

of its loan portfolios considering past experience, changes to federal student loan programs, current

economic conditions and other relevant factors.

Cash and Cash Equivalents

Cash and cash equivalents includes term federal funds, Eurodollar deposits, money market funds and

bank deposits with original terms to maturity of less than three months.

Restricted Cash and Investments

Restricted cash includes amounts restricted for on-balance sheet student loan securitizations, other

secured borrowings, as well as cash received from lending institutions pending disbursement for student

loans in connection with servicing student loans. Cash received from lending institutions that is invested

pending disbursement for student loans is restricted and cannot be disbursed for any other purpose. The

investments held must be instruments explicitly guaranteed by the United States government, or

instruments collateralized by securities guaranteed by the United States government. Generally, these

securities include Treasury bills, notes and bonds, and reverse repurchase agreements collateralized by

these instruments. Restricted cash and investments also includes cash received from students or parents

and owed to schools in connection with the tuition payment plan program of Academic Management

Services (“AMS”), acquired in the fourth quarter of 2003.

Investments

Investments are held to provide liquidity and to serve as a source of income. The majority of the

Company’s investments are classified as available-for-sale and such securities are carried at market value,

with the temporary changes in market value carried as a separate component of stockholders’ equity.

Changes in the market value for available-for-sale securities that have been designated as the hedged item

in a SFAS No. 133 fair value hedge (as it relates to the hedged risks) are recorded in the “gains (losses) on

derivative and hedging activities, net” line of the income statement offsetting changes in fair value of the

derivative which is hedging such investment. Temporary changes in market value of the security as it

relates to non hedged risks, are carried as a separate component of stockholders’ equity. The amortized

cost of debt securities in this category is adjusted for amortization of premiums and accretion of discounts,

which are amortized using the effective interest rate method. Impairment is evaluated considering several

factors including the length of time and extent to which the market value has been less than cost; the

financial condition and near-term prospects of the issuer; and the intent and ability to retain the