Sallie Mae 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

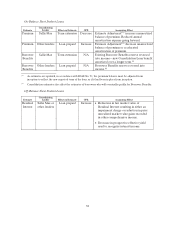

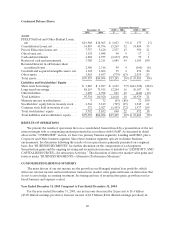

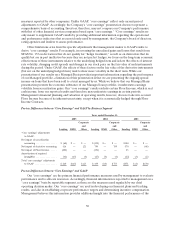

Average Balance Sheets

The following table reflects the rates earned on interest earning assets and paid on interest bearing

liabilities for the years ended December 31, 2005, 2004 and 2003. This table reflects the net interest margin

for the entire Company on a consolidated basis. It is included in the Lending segment discussion because

that segment includes substantially all interest earning assets and interest bearing liabilities.

Years ended December 31,

2005 2004 2003

Balance Rate Balance Rate Balance Rate

Average Assets

FFELP Stafford and Other Student Loans....... $20,720 4.90%$19,317 3.76%$17,687 3.71%

ConsolidationLoans.......................... 47,082 5.31 31,773 4.30 22,421 5.16

PrivateEducationLoans...................... 6,922 9.16 4,795 7.00 5,019 6.13

Otherloans.................................. 1,072 8.04 1,004 7.72 1,129 7.27

Cashandinvestments......................... 6,662 4.22 11,322 2.11 6,840 2.36

Total interestearning assets................... 82,458 5.48% 68,211 4.02% 53,096 4.45%

Non-interestearningassets.................... 6,990 6,497 5,950

Totalassets.................................. $89,448 $74,708 $59,046

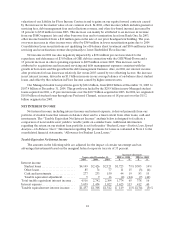

Average Liabilities and Stockholders’ Equity

Short-term borrowings ........................ $ 4,517 3.93%$10,596 1.95%$24,995 1.58%

Long-term borrowings ........................ 77,958 3.70 58,134 2.11 28,407 2.21

Total interestbearing liabilities ................ 82,475 3.71% 68,730 2.09% 53,402 1.91%

Non-interestbearingliabilities................. 3,555 3,195 3,169

Stockholders’equity.......................... 3,418 2,783 2,475

Total liabilities andstockholders’ equity......... $89,448 $74,708 $59,046

Netinterestmargin........................... 1.77% 1.92% 2.53%

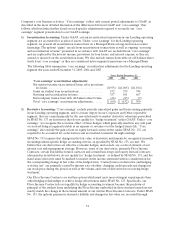

Rate/Volume Analysis

The following rate/volume analysis shows the relative contribution of changes in interest rates and

asset volumes.

Taxable

equivalent

increase

Increase

(decrease)

attributable to

change in

(decrease) Rate Volume

2005 vs. 2004

Taxable equivalent interest income................................... $1,774 $ 1,008 $ 766

Interest expense.................................................... 1,625 1,325 300

Taxable equivalent net interest income................................ $ 149 $ (317) $ 466

2004 vs. 2003

Taxable equivalent interest income................................... $ 378 $ (201) $ 579

Interest expense.................................................... 412 (16) 428

Taxable equivalent net interest income................................ $ (34) $ (185) $ 151

The decrease in the net interest margin in 2005 versus 2004 is primarily due to fluctuations in the

student loan spread as discussed under “Student Loans—Student Loan Spread Analysis—On-Balance

Sheet.” In addition to student loan spread related items, the net interest margin in 2004 was negatively