Sallie Mae 2005 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-8

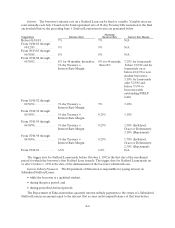

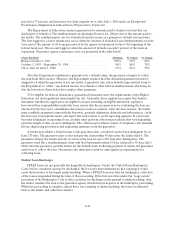

Repayment. Repayment of a Stafford Loan begins 6 months after the student ceases to be enrolled at

least half time. In general, each loan must be scheduled for repayment over a period of not more than 10

years after repayment begins. New borrowers on or after October 7, 1998 who accumulate outstanding

loans under the FFELP totaling more than $30,000 are entitled to extend repayment for up to 25 years,

subject to minimum repayment amounts and Consolidation loan borrowers may be scheduled for

repayment up to 30 years depending on the borrower’s indebtedness. The Higher Education Act currently

requires minimum annual payments of $600, unless the borrower and the lender agree to lower payments,

except that negative amortization is not allowed. The Act and related regulations require lenders to offer

the choice of a standard, graduated, income-sensitive and extended repayment schedule, if applicable, to

all borrowers entering repayment.

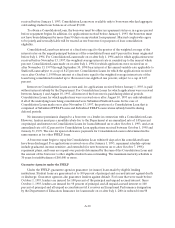

Grace Periods, Deferral Periods and Forbearance Periods. After the borrower stops pursuing at least a

half-time course of study, he must begin to repay principal of a Stafford Loan following the grace period.

However, no principal repayments need be made, subject to some conditions, during deferment and

forbearance periods.

For borrowers whose first loans are disbursed on or after July 1, 1993, repayment of principal may be

deferred while the borrower returns to school at least half-time. Additional deferrals are available, when

the borrower is:

•enrolled in an approved graduate fellowship program or rehabilitation program; or

•seeking, but unable to find, full-time employment (subject to a maximum deferment of 3 years); or

•having an economic hardship, as defined in the Act (subject to a maximum deferment of 3 years); or

•serving on active duty during a war or other military operation or national emergency, or

performing qualifying National Guard duty during a war or other military operation or national

emergency (subject to a maximum deferment of 3 years, and effective July 1, 2006 on loans made on

or after July 1, 2001).

The Higher Education Act also permits, and in some cases requires, “forbearance” periods from loan

collection in some circumstances. Interest that accrues during forbearance is never subsidized. Interest that

accrues during deferment periods may be subsidized.

PLUS and SLS Loan Programs

The Higher Education Act authorizes PLUS Loans to be made to graduate or professional students

(effective July 1, 2006) and parents of eligible dependent students and previously authorized SLS Loans to

be made to the categories of students now served by the Unsubsidized Stafford Loan program. Only

borrowers who have no adverse credit history or who are able to secure an endorser without an adverse

credit history are eligible for PLUS Loans. The basic provisions applicable to PLUS and SLS Loans are

similar to those of Stafford Loans for federal insurance and reinsurance. However, interest subsidy

payments are not available under the PLUS and SLS programs and, in some instances, special allowance

payments are more restricted.

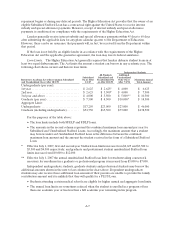

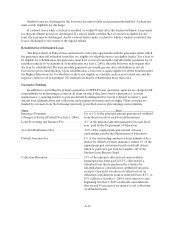

Loan Limits. PLUS and SLS Loans disbursed before July 1, 1993 were limited to $4,000 per

academic year with a maximum aggregate amount of $20,000.

The annual and aggregate amounts of PLUS Loans first disbursed on or after July 1, 1993 are limited

only to the difference between the cost of the student’s education and other financial aid received,

including scholarship, grants and other student loans.

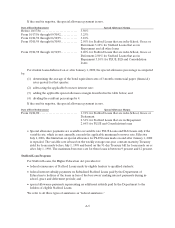

Interest. The interest rate for a PLUS or SLS Loan depends on the date of disbursement and period

of enrollment. The interest rates for PLUS Loans and SLS Loans are presented in the following chart.