Sallie Mae 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

PART I.

Item 1. Business

INTRODUCTION TO SLM CORPORATION

SLM Corporation, more commonly known as Sallie Mae, is the market leader in education finance.

SLM Corporation is a holding company that operates through a number of subsidiaries. (References in

this annual report to “the Company” refer to SLM Corporation and its subsidiaries). At December 31,

2005, we had approximately 11,000 employees.

We were formed 33 years ago as the Student Loan Marketing Association, a federally chartered

government-sponsored enterprise (the “GSE”), with the goal of furthering access to higher education by

providing a secondary market for student loans. On December 29, 2004, we completed a privatization

process that began in 1996 with the passage of the Privatization Act by defeasing the GSE’s remaining debt

obligations and dissolving its federal charter.

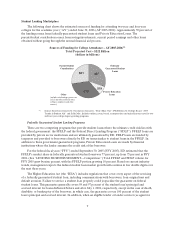

We are the largest private source of funding, delivery and servicing support for education loans in the

United States primarily, through our participation in the Federal Family Education Loan Program

(“FFELP”). We originate, acquire and hold student loans, with the net interest income and gains on the

sales of student loans in securitization being the primary source of our earnings. We also earn fees for pre-

default and post-default receivables management services. We have structured the Company to be the

premier player in every phase of the student loan life cycle—from originating and servicing student loans

to default aversion and debt management of delinquent and defaulted student loans. We also provide a

wide range of financial services, processing capabilities and information technology to meet the needs of

educational institutions, lenders, students and their families, and guarantee agencies.

In the education finance marketplace, we believe that what distinguishes us from our competition is

the breadth and sophistication of the products and services we offer to colleges, universities and students.

In addition to student loans, these offerings include the streamlining of the financial aid process through

university-branded websites, tuition payment plans, call centers and other solutions that support the

financial aid office.

In recent years we have diversified our business through the acquisition of several companies that

provide receivables management and debt collection services. Initially these acquisitions were

concentrated in the student loan industry, with General Revenue Corporation (“GRC”) and Pioneer

Credit Recovery (“PCR”), both purchased in 2002. In 2004 we acquired a majority stake in AFS Holdings,

LLC, the parent company of Arrow Financial Services, LLC (collectively, “AFS”), a debt management

company that purchases and services distressed debt in several industries including and outside of

education receivables. In 2005, we acquired GRP/AG Holdings, LLC (“GRP”), a debt management

company that acquires and manages portfolios of sub-performing and non-performing mortgage loans.

BUSINESS SEGMENTS

We provide our array of credit products and related services to the higher education and consumer

credit communities and others through two primary business segments: our Lending business segment and

our Debt Management Operations business segment, or DMO. These defined business segments operate

in distinct business environments and have unique characteristics and face different opportunities and

challenges. They are considered reportable segments under The Financial Accounting Standards Board’s

(“FASB’s”) Statement of Financial Accounting Standards (“SFAS”) No. 131, “Disclosures about Segments

of an Enterprise and Related Information,” based on quantitative thresholds applied to the Company’s

financial statements. In addition, within our Corporate and Other business segment, we provide a number

of complementary products and services to financial aid offices and schools that are managed within

smaller operating segments, the most prominent being our Guarantor Servicing and Loan Servicing