Sallie Mae 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214

|

|

39

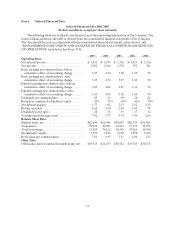

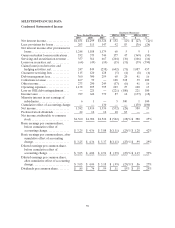

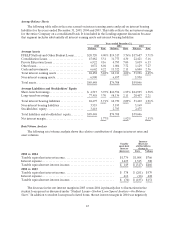

SELECTED FINANCIAL DATA

Condensed Statements of Income

Increase (Decrease)

Years Ended December 31, 2005 vs. 2004 2004 vs. 2003

2005 2004 2003 $ % $ %

Netinterestincome................. $1,451 $1,299 $1,326 $ 152 12% $ (27) (2)%

Less:provisionsforlosses ........... 203 111 147 92 83 (36) (24)

Net interest income after provisions for

losses........................... 1,248 1,188 1,179 60 5 9 1

Gains on student loan securitizations . 552 375 744 177 47 (369 ) (50)

Servicing and securitization revenue . . 357 561 667 (204) (36 ) (106 ) (16)

Losses onsecurities, net............. (64) (49) (10) (15) (31) (39) (390)

Gains (losses) on derivative and

hedging activities, net............. 247 849 (238) (602) (71) 1,087 457

Guarantorservicingfees ............ 115 120 128 (5) (4) (8) (6)

Debtmanagementfees.............. 360 300 259 60 20 41 16

Collections revenue ................ 167 39 — 128 328 39 100

Otherincome...................... 273 290 249 (17) (6) 41 16

Operatingexpenses................. 1,138 895 795 243 27 100 13

Loss on GSEdebt extinguishment.... — 221 — (221) (100) 221 100

Incometaxes ...................... 729 642 779 87 14 (137) (18)

Minority interest in net earnings of

subsidiaries...................... 6 1 — 5 500 1 100

Cumulative effect of accounting change — — 130 — — (130 ) (100)

Netincome........................ 1,382 1,914 1,534 (532) (28) 380 25

Preferredstockdividends ........... 22 12 12 10 83 — —

Net income attributable to common

stock ........................... $1,360 $1,902 $1,522 $ (542) (28 )% $ 380 25%

Basic earnings per common share,

before cumulative effect of

accounting change................ $ 3.25 $ 4.36 $ 3.08 $(1.11) (25)%$ 1.28 42%

Basic earnings per common share, after

cumulative effect of accounting

change.......................... $ 3.25 $ 4.36 $ 3.37 $(1.11) (25)%$ .99 29%

Diluted earnings per common share,

before cumulative effect of

accounting change................ $ 3.05 $ 4.04 $ 2.91 $ (.99) (25)%$ 1.13 39%

Diluted earnings per common share,

after cumulative effect of accounting

change.......................... $ 3.05 $ 4.04 $ 3.18 $ (.99) (25)%$ .86 27%

Dividendspercommonshare........ $ .85 $ .74 $ .59 $ .11 15% $ .15 25%