Sallie Mae 2005 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

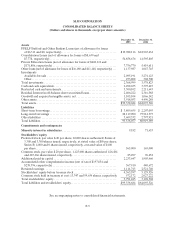

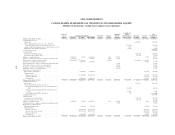

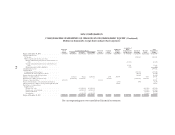

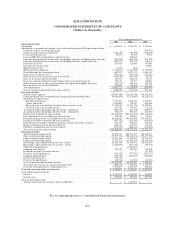

See accompanying notes to consolidated financial statements.

F-6

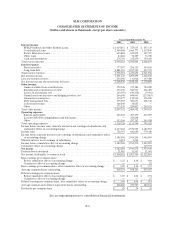

SLM CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(Dollars and shares in thousands, except per share amounts)

Years Ended December 31,

2005 2004 2003

Interest income:

FFELP Staffordand OtherStudent Loans................................. $1,014,851 $ 725,619 $ 655,519

Consolidation Loans.................................................. 2,500,008 1,364,777 1,157,849

Private Education Loans............................................... 633,884 335,451 307,477

Other loans ......................................................... 84,664 74,289 76,740

Cash and investments ................................................. 276,756 232,859 150,690

Total interest income ................................................... 4,510,163 2,732,995 2,348,275

Interest expense:

Short-term debt...................................................... 177,597 206,151 394,109

Long-term debt...................................................... 2,881,121 1,227,545 627,797

Total interest expense ................................................... 3,058,718 1,433,696 1,021,906

Net interest income ..................................................... 1,451,445 1,299,299 1,326,369

Less: provisions for losses ................................................ 203,006 111,066 147,480

Net interest income after provisions for losses................................ 1,248,439 1,188,233 1,178,889

Other income:

Gains on student loan securitizations ..................................... 552,546 375,384 744,289

Servicing and securitization revenue...................................... 356,730 560,971 666,409

Losses on investments, net ............................................. (63,955 ) (49,358 ) (9,932)

Gains (losses) on derivative and hedging activities, net ....................... 246,548 849,041 (237,815)

Guarantor servicing fees ............................................... 115,477 119,934 128,189

Debt management fees ................................................ 359,907 300,071 258,544

Collections revenue................................................... 166,840 38,687 —

Other.............................................................. 273,259 289,802 249,421

Total other income ..................................................... 2,007,352 2,484,532 1,799,105

Operating expenses:

Salaries and benefits.................................................. 625,024 497,170 432,007

Loss on GSE debt extinguishment and defeasance .......................... — 220,848 —

Other.............................................................. 513,304 397,762 363,018

Total operating expenses................................................. 1,138,328 1,115,780 795,025

Income before income taxes, minority interest in net earnings of subsidiaries and

cumulative effect of accounting change ................................... 2,117,

463 2,556,985 2,182,969

Income taxes.......................................................... 728,767 642,689 779,380

Income before minority interest in net earnings of subsidiaries and cumulative effect

of accounting change.................................................. 1,388,696 1,914,296 1,403,589

Minority interest in net earnings of subsidiaries .............................. 6,412 1,026 —

Income before cumulative effect of accounting change......................... 1,382,284 1,913,270 1,403,589

Cumulative effect of accounting change..................................... — — 129,971

Net income............................................................ 1,382,284 1,913,270 1,533,560

Preferred stock dividends ................................................ 21,903 11,501 11,501

Net income attributable to common stock ................................... $1,360,381 $ 1,901,769 $ 1,522,059

Basic earnings per common share:

Before cumulative effect of accounting change ............................. $ 3.25 $ 4.36 $ 3.08

Cumulative effect of accounting change................................... — — .29

Basic earnings per common share, after cumulative effect of accounting change .... $ 3.25 $

4.36 $ 3.37

Average common shares outstanding ....................................... 418,374 436,133 452,037

Diluted earnings per common share:

Before cumulative effect of accounting change ............................. $ 3.05 $ 4.04 $ 2.91

Cumulative effect of accounting change................................... — — .27

Diluted earnings per common share, after cumulative effect of accounting change. . . $ 3.05 $ 4.04 $ 3.18

Average common and common equivalent shares outstanding................... 460,260 475,787 482,104

Dividends per common share............................................. $ .85 $ .74 $ .59