Sallie Mae 2005 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-53

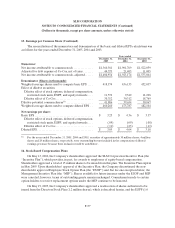

14. Stockholders’ Equity (Continued)

On June 8, 2005, the Company sold 4.0 million shares of Floating-Rate Non-Cumulative Preferred

Stock, Series B (the “Series B Preferred Stock”) in a registered public offering. Net proceeds from the sale

of the Series B Preferred Stock, after deducting underwriting fees and before other fees and expenses of

the offering, totaled approximately $397 million and are being used for general corporate purposes.

Dividends on the shares of Series B Preferred Stock are not mandatory. When, as, and if declared by the

Board of Directors of the Company, holders of Series B Preferred Stock are entitled to receive quarterly

dividends, based on 3-month LIBOR plus 70 basis points per annum in arrears, on and until June 15, 2011,

increasing to 3-month LIBOR plus 170 basis points per annum in arrears, after and including the period

beginning on June 15, 2011. For the year ended December 31, 2005, dividends paid on Series B Preferred

Stock reduced net income by $10 million.

The Series B Preferred Stock does not have a maturity date, but can be redeemed at the Company’s

option on any dividend payment date on or after June 15, 2010, at the redemption price of $100 per share

plus accrued and unpaid dividends for the then quarterly dividend period, if any. The Series B Preferred

Stock is not convertible into or exchangeable for any of the Company’s other securities or property. Upon

liquidation or dissolution of the Company, holders of the Series B Preferred Stock are entitled to receive

$100 per share, plus an amount equal to accrued and unpaid dividends for the then current quarterly

dividend period, if any, pro rata with holders of the Series A Preferred Stock and before any distribution of

assets are made to holders of the Company’s common stock.

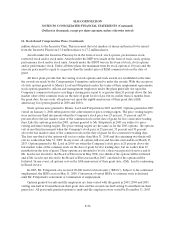

Common Stock

The Company’s shareholders have authorized the issuance of 1.1 billion shares of common stock (par

value of $.20). At December 31, 2005, 413.1 million shares were issued and outstanding and 80.6 million

shares were unissued but encumbered for outstanding convertible debt and outstanding options and

remaining authority for stock-based compensation plans. The convertible debt offering and stock-based

compensation plans are described in Note 8, “Long-Term Borrowings,” and Note 16, “Stock-Based

Compensation Plans,” respectively. The Company has also encumbered 330.3 million shares out of those

authorized for potential issuances for net share settlement of equity forward contracts.

In December 2005, the Company retired 65 million shares of common stock held in treasury at an

average price of $37.35 per share. This retirement decreased the balance in treasury stock by $2.4 billion,

with corresponding decreases of $13 million in common stock and $2.4 billion in retained earnings. In

September 2003, the Company retired 170 million shares of common stock held in treasury at an average

price of $18.04 per share. This retirement decreased the balance in treasury stock by $3.1 billion, with

corresponding decreases of $34 million in common stock and $3.1 billion in retained earnings.