Sallie Mae 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

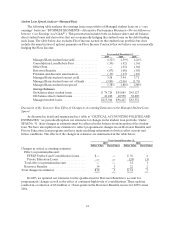

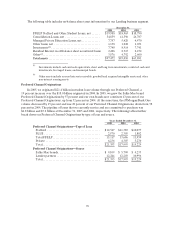

Forbearance—Managed Basis Private Education Loans

Private Education Loans are made to parent and student borrowers by our lender partners in

accordance with our underwriting policies. These loans generally supplement federally guaranteed student

loans, which are subject to federal lending caps. Private Education Loans are not guaranteed or insured

against any loss of principal or interest. Traditional student borrowers use the proceeds of these loans to

obtain higher education, which increases the likelihood of obtaining employment at higher income levels

than would be available without the additional education. As a result, the borrowers’ repayment capability

improves between the time the loan is made and the time they enter the post-education work force. We

generally allow the loan repayment period on traditional Private Education Loans, except those generated

by our SLM Financial subsidiary, to begin six to nine months after the student leaves school. This provides

the borrower time to obtain a job to service his or her debt. For borrowers that need more time or

experience other hardships, we permit additional delays in payment or partial payments (both referred to

as forbearances) when we believe additional time will improve the borrower’s ability to repay the loan.

Forbearance is also granted to borrowers who may experience temporary hardship after entering

repayment, when we believe that it will increase the likelihood of ultimate collection of the loan. Such

forbearance is only granted within established guidelines and is closely monitored for compliance. Our

policy does not grant any reduction in the repayment obligation (principal or interest) but does allow the

borrower to stop or reduce monthly payments for an agreed period of time. When a loan that was

delinquent prior to receiving forbearance, ends forbearance and re-enters repayment, that loan is

considered current.

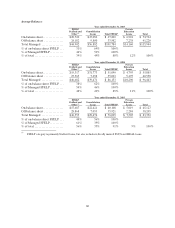

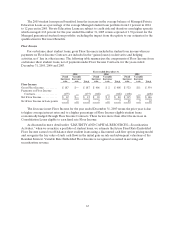

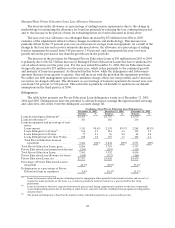

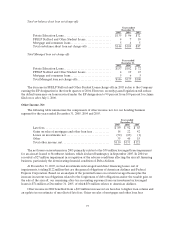

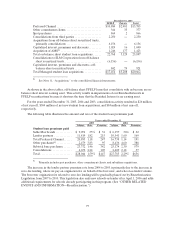

Forbearance is used most heavily immediately after the loan enters repayment. As indicated in the

tables below showing the composition and status of the Managed Private Education Loan portfolio by

number of months aged from the first date of repayment, the percentage of loans in forbearance decreases

the longer the loans have been in repayment. At December 31, 2005, loans in forbearance as a percentage

of loans in repayment and forbearance is 12.2 percent for loans that have been in repayment one to twenty-

four months. The percentage drops to 4.7 percent for loans that have been in repayment more than

48 months. Approximately 73 percent of our Managed Private Education Loans in forbearance have been

in repayment less than 24 months. These borrowers are essentially extending their grace period as they

transition to the workforce. Forbearance continues to be a positive collection tool for the Private

Education Loans as we believe it can provide the borrower with sufficient time to obtain employment and

income to support his or her obligation. We consider the potential impact of forbearance in the

determination of the loan loss reserves.