Sallie Mae 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

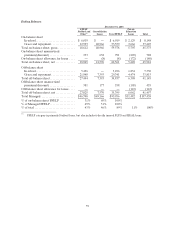

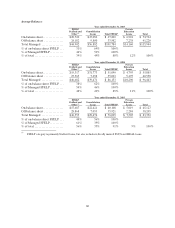

Private Education Loans

Allowance for Private Education Loan Losses

Change in Accounting Estimate to the Allowance for Loan Losses and the Recognition of Accrued Interest

Income for Private Education Loans

We maintain an allowance for loan losses at an amount sufficient to absorb losses inherent in our

Private Education Loan portfolio at the reporting date based on a projection of probable net credit losses.

The maturing of our Private Education Loan portfolios has provided us with more historical data on

borrower default behavior such that we now analyze those portfolios to determine the effects that the

various stages of delinquency have on borrower default behavior and ultimate charge-off. As a result, in

the second quarter of 2005, we changed our estimate of the allowance for loan losses for our Managed loan

portfolio using a migration analysis of delinquent and current accounts. A migration analysis is a technique

used to estimate the likelihood that a loan receivable may progress through the various delinquency stages

and ultimately charge-off. This is a widely used reserving methodology in the consumer finance industry.

Previously, we calculated the allowance for Private Education Loan losses by estimating the probable

losses in the portfolio based primarily on loan characteristics and where pools of loans were in their life

with less emphasis on current delinquency status of the loan. Also, in our prior methodology for calculating

the allowance, some loss rates were based on proxies and extrapolations of FFELP loan loss data.

We also used a migration analysis to revise our estimates pertaining to our non-accrual policy for

interest income. Under the new methodology, we estimate the amount of uncollectible accrued interest on

Private Education Loans and write it off against current period interest income. Under our prior

methodology, Private Education Loans continued to accrue interest, including in periods of forbearance,

until they were charged off, at which time the loans were placed on non-accrual status and all previously

accrued interest was reversed against income in the month of charge-off. The allowance for loan losses

provided for a portion of the probable losses in accrued interest receivable prior to charge-off.

This change in reserving methodology has been accounted for as a change in estimate in accordance

with APB Opinion No. 20, “Accounting Changes.” The effect of this change in estimate was to increase the

value of the allowance by $40 million and to reduce student loan interest income for the estimate of

uncollectible accrued interest receivable by $14 million. On the income statement, adjustments to the

allowance are recorded through the provisions for loan losses whereas adjustments to accrued interest are

recorded in interest income. On a Managed Basis, we decreased the allowance for loan losses by

$20 million and reduced student loan interest income by $16 million for uncollectible accrued interest.

We continue to gain experience in analyzing our Private Education Loan portfolios and as a result, we

have developed additional data to better estimate the amount of recoveries on defaulted loans. During the

third quarter of 2005, we changed our methodology for estimating the amount of charged-off student loans

that will ultimately be recovered, which resulted in a $49 million decrease in the value of the allowance

through the provisions for loan losses. On a Managed Basis, we decreased the allowance for loan losses by

$65 million to recognize the effect of this change.

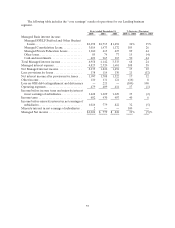

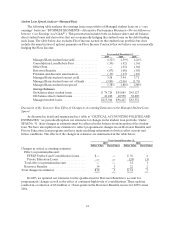

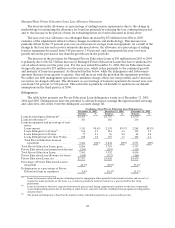

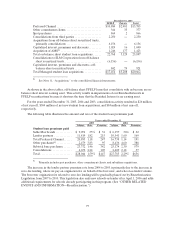

The following table provides a summary of the income statement impact of the change in accounting

estimate and change in recovery methodology on the allowance for loan losses.

On-

Balance

Sheet

Off-

Balance

Sheet

Managed

Basis

Impact on provisions:

Impact of change in allowance estimate............... $ 40 $(60) $(20)

Impact of change in recovery estimate ................ (49) (16) (65)

Total impact from changes in estimates ............... $ (9) $(76) $(85)