Sallie Mae 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

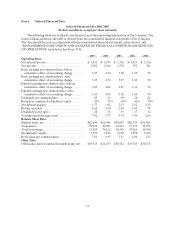

40

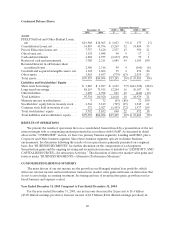

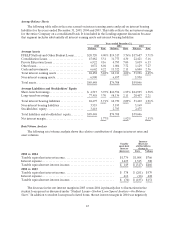

Condensed Balance Sheets

Increase (decrease)

December 31, 2005 vs. 2004 2004 vs. 2003

2005 2004 $ % $ %

Assets

FFELP Stafford and Other Student Loans,

net................................... $19,988 $18,965 $ 1,023 5 % $ 175 1%

ConsolidationLoans,net.................. 54,859 41,596 13,263 32 14,809 55

PrivateEducationLoans,net .............. 7,757 5,420 2,337 43 950 21

Otherloans,net.......................... 1,138 1,048 90 9 17 2

Cashandinvestments..................... 4,868 6,975 (2,107) (30) 79 1

Restricted cash and investments............ 3,300 2,211 1,089 49 1,105 100

Retained Interest in off-balance sheet

securitized loans ....................... 2,406 2,316 90 4 (160 ) (6)

Goodwill and acquired intangible assets, net . 1,105 1,066 39 4 474 80

Otherassets............................. 3,918 4,497 (579) (13) 2,034 83

Totalassets.............................. $99,339 $84,094 $ 15,245 18 % $ 19,483 30%

Liabilities and Stockholders’ Equity

Short-term borrowings .................... $ 3,810 $ 2,207 $ 1,603 73%$(16,528) (88)%

Long-term borrowings .................... 88,119 75,915 12,204 16 36,107 91

Otherliabilities.......................... 3,609 2,798 811 29 (640) (19)

Totalliabilities........................... 95,538 80,920 14,618 18 18,939 31

Minority interest insubsidiaries............ 9 72 (63) (88) 72 100

Stockholders’ equity before treasury stock . . . 4,364 5,129 (765) (15 ) 1,949 61

Common stock held in treasury at cost...... 572 2,027 (1,455) (72) 1,477 269

Total stockholders’ equity................. 3,792 3,102 690 22 472 18

Total liabilities andstockholders’ equity..... $99,339 $84,094 $ 15,245 18 % $ 19,483 30%

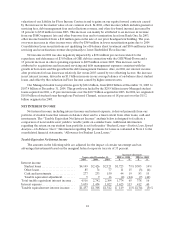

RESULTS OF OPERATIONS

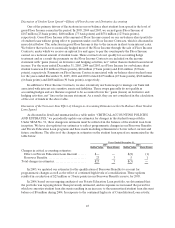

We present the results of operations first on a consolidated basis followed by a presentation of the net

interest margin with accompanying analysis presented in accordance with GAAP. As discussed in detail

above in the “OVERVIEW” section, we have two primary business segments, Lending and DMO, plus a

Corporate and Other business segment. Since these business segments operate in distinct business

environments, the discussion following the results of our operations is primarily presented on a segment

basis. See “BUSINESS SEGMENTS” for further discussion on the components of each segment.

Securitization gains and the ongoing servicing and securitization income is included in “LIQUIDITY AND

CAPITAL RESOURCES—Securitization Activities.” The discussion of derivative market value gains and

losses is under “BUSINESS SEGMENTS—Alternative Performance Measures.”

CONSOLIDATED EARNINGS SUMMARY

The main drivers of our net income are the growth in our Managed student loan portfolio, which

drives net interest income and securitization transactions, market value gains and losses on derivatives that

do not receive hedge accounting treatment, the timing and size of securitization gains, growth in our fee-

based business and expense control.

Year Ended December 31, 2005 Compared to Year Ended December 31, 2004

For the year ended December 31, 2005, our net income decreased by 26 percent to $1.4 billion

($3.05 diluted earnings per share) from net income of $1.9 billion ($4.04 diluted earnings per share) in