Sallie Mae 2005 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-51

13. Commitments, Contingencies and Guarantees (Continued)

JPMorgan Chase will continue to sell all student loans to the Company (whether made under the

Chase or Bank One brand) that are originated or serviced on the Company’s platforms. In addition, the

agreement provides that substantially all Chase-branded education loans made for the July 1, 2005 to

June 30, 2006 academic year (and future loans made to these borrowers) will be sold to the Company,

including certain loans that are not originated or serviced on Sallie Mae platforms.

This agreement permits JPMorgan Chase to compete with the Company in the student loan

marketplace and releases the Company from its commitment to market the Bank One and Chase brands

on campus. The Company will continue to support its school customers through its comprehensive set of

products and services, including its loan origination and servicing platforms, its family of lending brands

and strategic lending partners.

The Company offers a line of credit to certain financial institutions and other institutions in the higher

education community for the purpose of buying or originating student loans. In the event that a line of

credit is drawn upon, the loan is collateralized by underlying student loans. The contractual amount of

these financial instruments represents the maximum possible credit risk should the counterparty draw

down the commitment, and the counterparty subsequently fails to perform according to the terms of its

contract with the Company.

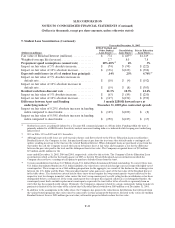

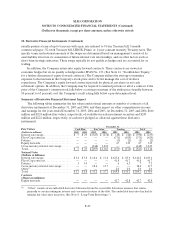

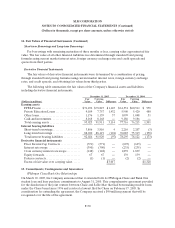

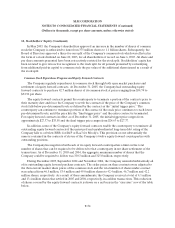

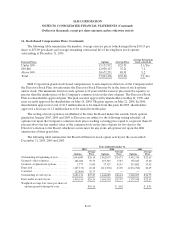

Commitments outstanding are summarized below:

December 31,

2005 2004

Student loan purchase commitments(1)(2) .............. $50,701,995 $47,247,669

Lines ofcredit..................................... 1,489,403 887,790

Letters of credit ................................... — 157,674

$ 52,191,398 $ 48,293,133

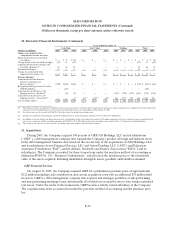

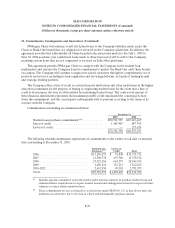

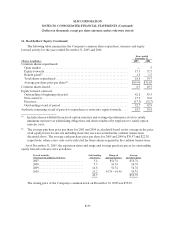

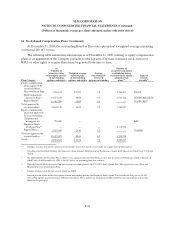

The following schedule summarizes expirations of commitments to the earlier of call date or maturity

date outstanding at December 31, 2005.

Student Loan

Purchases(1)(2) Letters of

Credit Total

2006................................... $11,296,871 $ 74,840 $11,371,711

2007................................... 11,780,738 497,786 12,278,524

2008................................... 23,523,186 663,579 24,186,765

2009................................... 1,409,210 153,215 1,562,425

2010-2022.............................. 2,691,990 99,983 2,791,973

Total.................................. $50,701,995 $1,489,403 $52,191,398

(1) Includes amounts committed at specified dates under forward contracts to purchase student loans and

estimated future requirements to acquire student loans from lending partners based on expected future

volumes at contractually committed rates.

(2) These commitments are not accounted for as derivatives under SFAS No. 133 as they do not meet the

definition of a derivative due to the lack of a fixed and determinable purchase amount.