Sallie Mae 2005 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-31

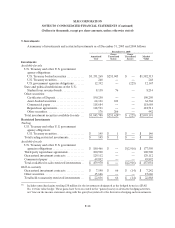

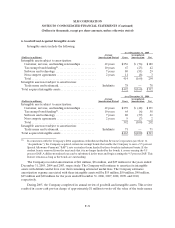

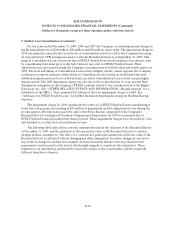

6. Goodwill and Acquired Intangible Assets

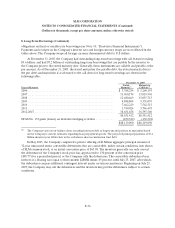

Intangible assets include the following:

As of December 31 , 2005

(Dollars in millions)

Average

Amortization Period Gross

Accumulated

Amortization Net

Intangible assets subject to amortization:

Customer, services, and lending relationships ........... 12 years $256 $ (76) $180

Tax exempt bond funding(1) ........................... 10years 67 (25) 42

Software andtechnology............................. 7 years 80 (51) 29

Non-compete agreements ............................ 2 years 11 (8) 3

Total .............................................. 414 (160) 254

Intangible assets not subject to amortization:

Trade name and trademark........................... Indefinite 78 — 78

Total acquired intangible assets ......................... $492 $(160) $332

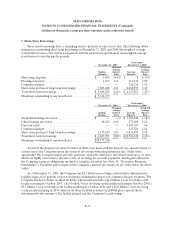

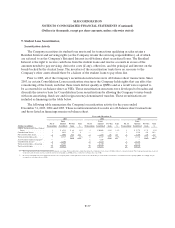

As of December 31 , 2004

(Dollars in millions)

Average

Amortization Period Gross

Accumulated

Amortization Net

Intangible assets subject to amortization:

Customer, services, and lending relationships .......... 12 years $239 $ (48) $191

Tax exempt bond funding(1) .......................... 10years 64 (6) 58

Software andtechnology............................ 7 years 80 (39) 41

Non-compete agreements ........................... 2 years 9 (7) 2

Total ............................................. 392 (100) 292

Intangible assets not subject to amortization:

Trade name and trademark.......................... Indefinite 71 — 71

Total acquired intangible assets ........................ $463 $(100) $363

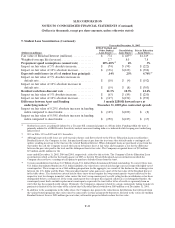

(1) In connection with the Company’s 2004 acquisition of Southwest Student Services Corporation (see Note 11,

“Acquisitions”), the Company acquired certain tax exempt bonds that enable the Company to earn a 9.5 percent

Special Allowance Payment (“SAP”) rate on student loans funded by those bonds in indentured trusts. If the

student loan is removed from the trust such that it is no longer funded by the bonds, it ceases earning the 9.5

percent SAP. A different student loan can be substituted in the trust and begin earning the 9.5 percent SAP. This

feature remains as long as the bonds are outstanding.

The Company recorded amortization of $61 million, $36 million, and $27 million for the years ended

December 31, 2005, 2004 and 2003, respectively. The Company will continue to amortize its intangible

assets with definite useful lives over their remaining estimated useful lives. The Company estimates

amortization expense associated with these intangible assets will be $55 million, $50 million, $40 million,

$25 million and $20 million for the years ended December 31, 2006, 2007, 2008, 2009, and 2010,

respectively.

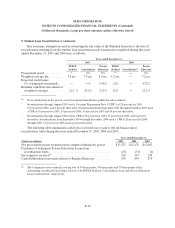

During 2005, the Company completed its annual review of goodwill and intangible assets. This review

resulted in a non-cash pre-tax charge of approximately $1 million to write-off the value of the trade names