Sallie Mae 2005 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.93

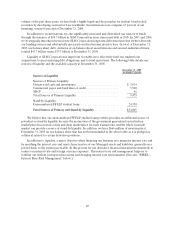

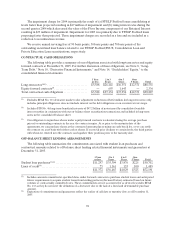

We have issued lending-related financial instruments including lines of credit to meet the financing

needs of our customers. The contractual amount of these financial instruments represents the maximum

possible credit risk should the counterparty draw down the commitment and the counterparty subsequently

fails to perform according to the terms of our contract. The remaining total contractual amount available

to be borrowed under these commitments is $1.5 billion. We do not believe that these instruments are

representative of our actual future credit exposure or funding requirements. To the extent that the lines of

credit are drawn upon, the balance outstanding is collateralized by student loans. At December 31, 2005,

draws on lines of credit were approximately $241 million, which amount is reflected in other loans in the

consolidated balance sheet. For additional information, see Note 13, “Commitments, Contingencies and

Guarantees,” to the consolidated financial statements.

RISKS

Overview

Managing risks is an essential part of successfully operating a financial services company. Our most

prominent risk exposures are operational, market and interest rate, political and regulatory, liquidity,

credit, and Consolidation Loan refinancing risk. We discuss these and other risks in the “Risk Factors”

section (Item 1A) of this document. The discussion that follows enhances that disclosure by discussing the

risk management strategies employed by the Company to mitigate these risks.

Operational Risk

Operational risk can result from regulatory compliance errors, servicing errors (see further discussion

below), technology failures, breaches of the internal control system, and the risk of fraud or unauthorized

transactions by employees or persons outside the Company. This risk of loss also includes the potential

legal actions that could arise as a result of an operational deficiency or as a result of noncompliance with

applicable regulatory standards and contractual commitments, adverse business decisions or their

implementation, and customer attrition due to potential negative publicity.

The federal guarantee on our student loans and our designation as an Exceptional Performer by ED is

conditioned on compliance with origination and servicing standards set by ED and guarantor agencies. A

mitigating factor is our ability to cure servicing deficiencies and historically our losses have been small.

Should we experience a high rate of servicing deficiencies, the cost of remedial servicing or the eventual

losses on the student loans that are not cured could be material. Our servicing and operating processes are

highly dependent on our information system infrastructure, and we face the risk of business disruption

should there be extended failures of our information systems, any number of which could have a material

impact on our business. To mitigate these risks we have a number of back-up and recovery plans in the

event of systems failures, which are tested regularly and monitored constantly.

We manage operational risk through our risk management and internal control processes, which

involve each business line including independent cost centers, such as servicing, as well as executive

management. The business lines have direct and primary responsibility and accountability for identifying,

controlling, and monitoring operational risk, and each business line manager maintains a system of

controls with the objective of providing proper transaction authorization and execution, proper system

operations, safeguarding of assets from misuse or theft, and ensuring the reliability of financial and other

data. We have centralized certain staff functions such as accounting, human resources and legal to further

strengthen our operational controls. While we believe that we have designed effective methods to

minimize operational risks, our operations remain vulnerable to natural disasters, human error, technology

and communication system breakdowns and fraud.