Sallie Mae 2005 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-35

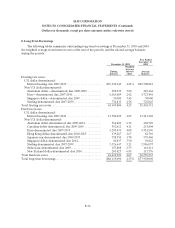

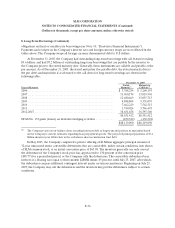

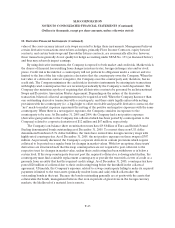

8. Long-Term Borrowings (Continued)

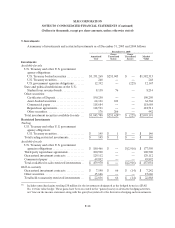

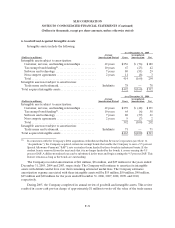

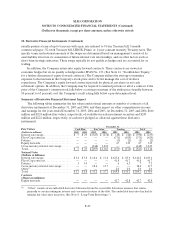

December 31, 2004

Year Ended

December 31,

2004

Ending

Balance

Weighted

Average

Interest

Rate

Average

Balance

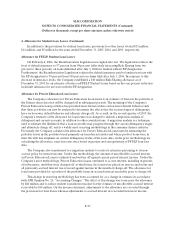

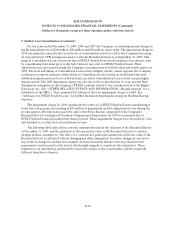

Floating rate notes:

U.S. dollar denominated:

Interestbearing,due2006-2047......................... $ 47,792,701 2.48% $ 35,023,181

Non U.S. dollar denominated:

Australian dollar—denominated, due 2009............... 164,003 5.82 102,150

Euro—denominated, due 2006-2040..................... 4,339,287 2.33 2,321,228

Singapore dollar—denominated, due 2009 ............... 30,000 1.58 25,492

Sterling-denominated,due2006-2039.................... 722,571 5.08 570,479

Total floatingrate notes.................................... 53,048,562 2.51 38,042,530

Fixed rate notes:

U.S. dollar denominated:

Interest bearing, due2006-2043......................... 12,614,188 4.67 12,923,633

Zero coupon ......................................... — — 204,890

Non U.S. dollar denominated:

Australian dollar-denominated, due 2009 ................ 310,949 5.70 169,779

Canadian dollar-denominated, due 2009................. 167,262 4.32 11,490

Euro-denominated, due 2006-2039...................... 5,728,710 3.27 4,047,730

HongKong dollar-denominated, due 2014 ............... 26,563 4.70 22,945

Japanese yen-denominated, due 2009-2034 ............... 453,211 1.63 277,526

Singapore dollar-denominated, due 2014................. 66,498 3.56 52,055

Sterling-denominated,due2006-2039.................... 3,319,666 4.51 2,305,444

Swiss franc-denominated, due 2009...................... 178,964 2.37 75,800

Total fixed rate notes ...................................... 22,866,011 4.22 20,091,292

Totallong-termborrowings................................. $ 75,914,573 3.03% $ 58,133,822

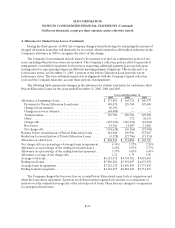

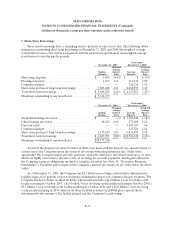

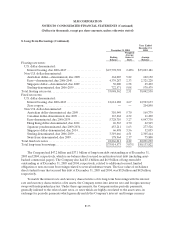

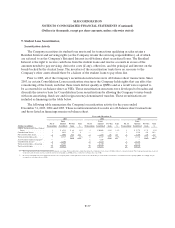

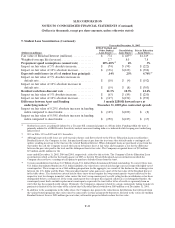

The Company had $47.2 billion and $37.1 billion of long-term debt outstanding as of December 31,

2005 and 2004, respectively, which is on-balance sheet secured securitization trust debt (including asset-

backed commercial paper). The Company also had $3.4 billion and $6.9 billion of long-term debt

outstanding as of December 31, 2005 and 2004, respectively, related to additional secured, limited

obligation or non-recourse borrowings related to several indenture trusts. The face value of on-balance

sheet student loans that secured this debt at December 31, 2005 and 2004, was $52 billion and $42 billion,

respectively.

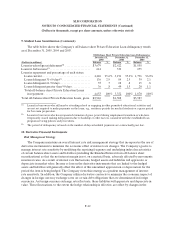

To match the interest rate and currency characteristics of its long-term borrowings with the interest

rate and currency characteristics of its assets, the Company enters into interest rate and foreign currency

swaps with independent parties. Under these agreements, the Company makes periodic payments,

generally indexed to the related asset rates, or rates which are highly correlated to the asset rates, in

exchange for periodic payments which generally match the Company’s interest and foreign currency