Sallie Mae 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

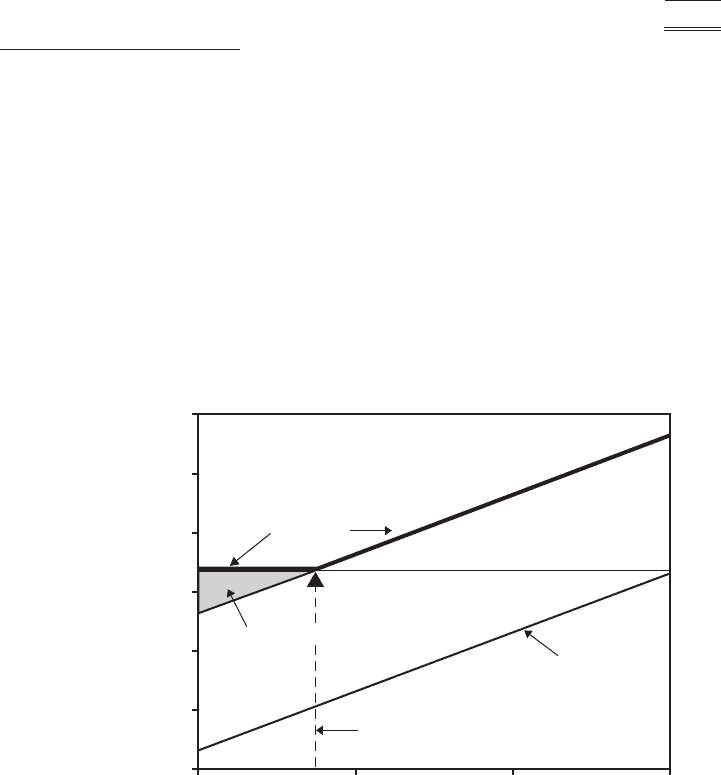

Income for an extended period of time, and for those loans where the borrower interest rate is reset

annually on July 1, we may earn Floor Income to the next reset date.

The following example shows the mechanics of Floor Income for a typical fixed rate Consolidation

Loan originated after July 1, 2005 (with a commercial paper-based SAP spread of 2.64 percent):

Fixed Borrower Rate: .............................................. 5.375%

SAP Spread over Commercial Paper Rate:............................ (2.640)%

Floor Strike Rate(1)................................................. 2.735%

(1) The interest rate at which the underlying index (Treasury bill or commercial paper) plus the

fixed SAP spread equals the fixed borrower rate. Floor Income is earned anytime the

interest rate of the underlying index declines below this rate.

Based on this example, if the quarterly average commercial paper rate is over 2.735 percent, the

holder of the student loan will earn at a floating rate based on the SAP formula, which in this example is a

fixed spread to commercial paper of 2.64 percent. On the other hand, if the quarterly average commercial

paper rate is below 2.735 percent, the SAP formula will produce a rate below the fixed borrower rate of

5.375 percent and the loan holder earns at the borrower rate of 5.375 percent. The difference between the

fixed borrower rate and the lender’s expected yield based on the SAP formula is referred to as Floor

Income. Our student loan assets are generally funded with floating rate debt, so when student loans are

earning at the fixed borrower rate, decreases in interest rates may increase Floor Income.

Graphic Depiction of Floor Income:

Yield

Commercial Paper Rate

Floor Strike Rate @ 2.735%

Floating Rate Debt

Fixed Borrower Rate

Fixed Borrower Rate = 5.375%

Special Allowance Payments (SAP) Spread = 2.64%

Lender Yield

2.00%

2.00% 3.00% 4.00% 5.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

Floor Income

Floor Income Contracts—We enter into contracts with counterparties under which, in exchange for

an upfront fee representing the present value of the Floor Income that we expect to earn on a notional

amount of underlying student loans being economically hedged, we will pay the counterparties the Floor

Income earned on that notional amount over the life of the Floor Income Contract. Specifically, we agree

to pay the counterparty the difference, if positive, between the fixed borrower rate less the SAP (see

definition below) spread and the average of the applicable interest rate index on that notional amount,

regardless of the actual balance of underlying student loans, over the life of the contract. The contracts