Sallie Mae 2005 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-59

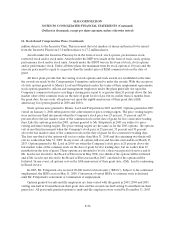

16. Stock-Based Compensation Plans (Continued)

Performance stock granted under the MIP and the Incentive Plan must vest over a minimum of a

12-month performance period. Performance criteria may include the achievement of any of several

financial and business goals, such as “core earnings” per share, loan volume, market share, overhead or

other expense reduction, or “core earnings” net income. Restricted stock may be granted under the

Incentive Plan and may vest no sooner than three years from grant date or may vest ratably over three

years. In 2005, 2004 and 2003, the amount of performance stock and RSUs granted was 226,681 shares,

592,534 shares and 464,465 shares, respectively.

Employees may purchase shares of the Company’s common stock under the ESPP at the end of a

24-month period at a price equal to the share price at the beginning of the 24-month period, less 15

percent, up to a maximum purchase price of $10,000 plus accrued interest.

In 2000, the Company established a replacement option program to assist executive officers in

meeting their share ownership targets. Under the replacement program, officers and Board members have

been eligible to receive new options upon their exercise of vested options in an amount equal to the

number of shares needed to pay the exercise price for the original option. Replacement options carry an

exercise price equal to the fair market value of the Company’s common stock on the date of their grant

and vest one year from the grant date. The term of replacement options equals the remaining term of the

underlying options. The options granted to Messrs. Lord and Fitzpatrick in 2003 are not eligible for

replacement options. Further, the Company’s Compensation Committee determined that, with the

exception of newly hired or promoted officers, options granted to other officers after 2003 would not be

eligible for replacement options.

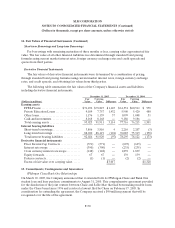

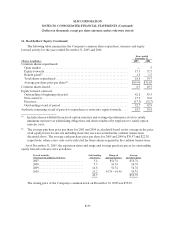

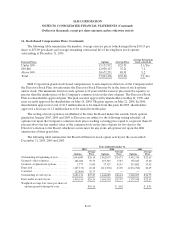

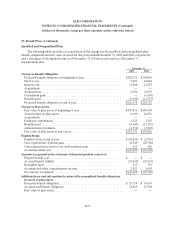

The following table summarizes the employee stock option activity for the years ended December 31,

2005, 2004 and 2003. The weighted average fair value of options granted during the year is based on a

Black-Scholes option pricing model.

Years Ended December 31,

2005 2004 2003

Options

Average

Price Options

Average

Price Options

Average

Price

Outstanding at beginning of year .... 38,748,318 $ 31.45 42,400,231 $ 28.93 43,828,155 $ 26.03

Granted—direct options ........... 7,622,450 51.28 6,204,181 41.11 10,009,627 36.18

Granted—replacement options...... 154,088 50.85 633,210 43.03 1,184,374 37.70

Exercised........................ (7,482,456) 31.16 (9,231,460) 26.51 (10,833,755 ) 24.50

Canceled ........................ (1,179,144) 43.69 (1,257,844) 36.27 (1,788,170 ) 31.02

Outstanding at end of year ......... 37,863,256 $ 35.20 38,748,318 $ 31.45 42,400,231 $ 28.93

Exercisable at end of year.......... 24,148,491 $ 29.27 19,805,143 $ 27.71 20,445,682 $ 24.51

Weighted-average fair value per share

of options granted during the year . $ 8.64 $ 5.14 $ 6.95