Sallie Mae 2005 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

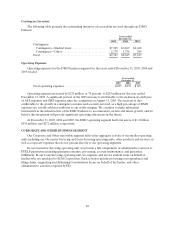

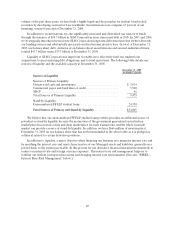

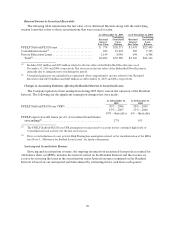

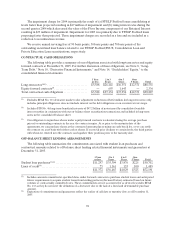

Retained Interest in Securitized Receivables

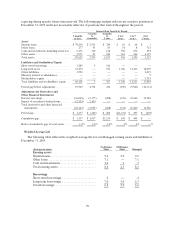

The following table summarizes the fair value of our Retained Interests along with the underlying

student loans that relate to those securitizations that were treated as sales.

As of December 31, 2005 As of December 31, 2004

Retained

Interest

Fair Value

Underlying

Securitized

Loan

Balance

Retained

Interest

Fair Value

Underlying

Securitized

Loan

Balance

FFELPStafford/PLUSloans ......................... $ 774 $ 20,371 $ 1,037 $ 27,445

Consolidation Loans(1) ............................... 483 10,272 585 7,393

Private Education Loans............................. 1,149 8,946 694 6,308

Total(2) ........................................... $ 2,406 $ 39,589 $ 2,316 $ 41,146

(1) Includes $235 million and $399 million related to the fair value of the Embedded Floor Income as of

December 31, 2005 and 2004, respectively. The decrease in the fair value of the Embedded Floor Income is

primarily due to rising interest rates during the period.

(2) Unrealized gains (pre-tax) included in accumulated other comprehensive income related to the Retained

Interests totaled $370 million and $445 million as of December 31, 2005 and 2004, respectively.

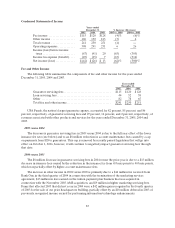

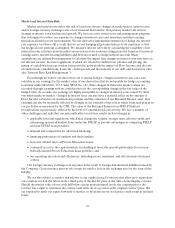

Changes in Accounting Estimates Affecting the Residual Interest in Securitized Loans

The Company updated certain assumptions during 2005 that it uses in the valuation of the Residual

Interest. The following are the significant assumption changes that were made:

As of December 31,

2005

As of December 31,

2004

FFELP Stafford/PLUS loan CPR(1) .......................... 20% – 2006 20% – 2005

15% – 2007 15% – 2006

10% – thereafter 6% – thereafter

FFELP expected credit losses (as a% of securitized loan balance

outstanding)(2) .......................................... .17% 0%

(1) The FFELP Stafford/PLUS loan CPR assumption was increased to account for the continued high levels of

Consolidation Loan activity over the last several years.

(2) Due to reintroduction of a one percent Risk Sharing loss assumption related to the reauthorization of the HEA

(see Note 4, “Allowance for Student Loan Losses” for further discussion).

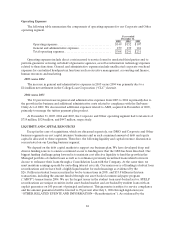

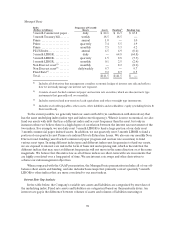

Servicing and Securitization Revenue

Servicing and securitization revenue, the ongoing revenue from securitized loan pools accounted for

off-balance sheet as QSPEs, includes the interest earned on the Residual Interest and the revenue we

receive for servicing the loans in the securitization trusts. Interest income recognized on the Residual

Interest is based on our anticipated yield determined by estimating future cash flows each quarter.