Sallie Mae 2005 Annual Report Download - page 139

Download and view the complete annual report

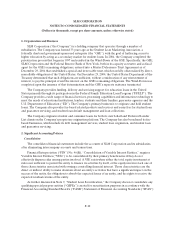

Please find page 139 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-17

2. Significant Accounting Policies (Continued)

“trading” for GAAP purposes and as a result they are marked-to-market through GAAP earnings

with no consideration for the price fluctuation of the economically hedged item.

Net settlement income/expense on derivatives and realized gains/losses related to derivative

dispositions (“gains (losses) on derivative and hedging activities—realized,” as reported in Note 10

“Derivative Financial Instruments”) that do not qualify as hedges under SFAS No. 133 are included in the

“gains (losses) on derivative and hedging activities, net” line item on the income statement. As a result, the

“gains (losses) on derivative and hedging activities, net” line item includes the unrealized changes in the

fair value of the Company’s derivatives (except effective cash flow hedges which are recorded in other

comprehensive income), the unrealized changes in fair value of hedged items in qualifying fair value

hedges, as well as the realized changes in fair value related to derivative net settlements and dispositions

that do not qualify for hedge accounting. Net settlement income/expense on derivatives that qualify as

hedges under SFAS No. 133 are included with the income or expense of the hedged item (mainly interest

expense).

Foreign Currency Transactions

Transaction gains and losses resulting from exchange rate changes on transactions denominated in

currencies other than the functional currency are included in net income.

SFAS No. 150

Under SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of both

Liabilities and Equity,” equity forward contracts that allow a net settlement option either in cash or the

Company’s stock are required to be accounted for in accordance with SFAS No. 133 as derivatives. As a

result, the Company marks its equity forward contracts to market through earnings in the “gains (losses)

on derivative and hedging activities, net” line item on the income statement along with the net settlement

expense on the contracts. In accordance with SFAS No. 150, equity forward contracts that were entered

into prior to June 1, 2003 and outstanding at July 1, 2003, were marked-to-market on July 1, 2003 and

resulted in a gain of $130 million, which was reflected as a “cumulative effect of accounting change” in the

consolidated statements of income.

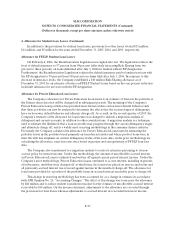

Debt Management Fees and Collections Revenue

In the purchased receivables business, the Company focuses on various types of consumer debt with

an emphasis on charged off credit card receivables, as well as sub-performing and nonperforming mortgage

loans. The Company accounts for its investments in charged off receivables and sub-performing and

nonperforming mortgage loans in accordance with AICPA Statement of Position (“SOP”) 03-3,

“Accounting for Certain Loans or Debt Securities Acquired in a Transfer.” Under the standard, the

Company establishes static pools of homogeneous accounts and initially records them at fair value, based

on each pool’s estimated cash flow and internal rate of return. The Company recognizes income each

month based on each static pool’s effective interest rate and allocates monthly cash collections to interest

and principal based on each pool’s estimated internal rate of return. The static pools are tested monthly for

impairment by re-estimating the future cash flows to be received from the pools. Subsequent increases in

estimated future cash flows are recognized prospectively through a yield adjustment over the remaining life

of the static pool. If the new estimated cash flows are less than previously estimated, the Company records