Sallie Mae 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

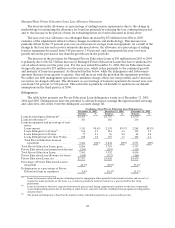

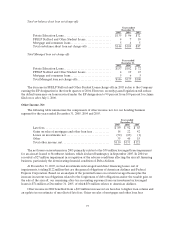

75

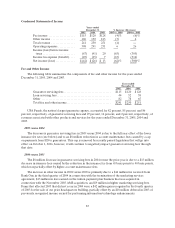

December 31, 2003

FFELP Private Total

PreferredChannel................................ $10,884 $2,901 $ 13,785

Other commitment clients ......................... 344 33 377

Spot purchases ................................... 864 2 866

Consolidations from third parties................... 2,250 — 2,250

Acquisitions from off-balance sheet securitized trusts,

primarily consolidations ......................... 6,156 — 6,156

Capitalized interest, premiums and discounts ......... 1,024 16 1,040

Acquisition of AMS(1) ............................. 1,246 177 1,423

Total on-balance sheet student loan acquisitions ...... 22,768 3,129 25,897

Consolidations to SLM Corporation from off-balance

sheet securitized trusts........................... (6,156) — (6,156 )

Capitalized interest, premiums and discounts—off-

balance sheetsecuritized trusts................... 842 79 921

Total Managed student loan acquisitions............. $17,454 $3,208 $ 20,662

(1) See Note 11, “Acquisitions,” to the consolidated financial statements.

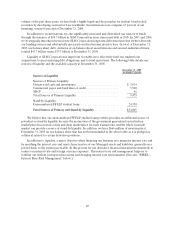

As shown in the above tables, off-balance sheet FFELP loans that consolidate with us become an on-

balance sheet interest earning asset. This activity results in impairments of our Residual Interests in

FFELP securitizations because it shortens the time that the Residual Interest is an earning asset.

For the years ended December 31, 2005, 2004 and 2003, consolidation activity resulted in $26 million

of net run-off, $504 million of net new student loan acquisitions, and $84 million of net run-off,

respectively.

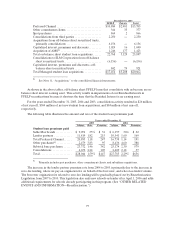

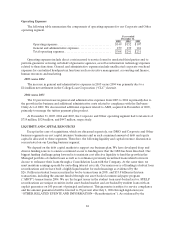

The following table illustrates the amount and rate of the student loan premiums paid.

Years ended December 31,

2005 2004

Volume Rate Premium Volume Rate Premium

Student loan premiums paid:

Sallie Mae brands............ $ 9,074 .35% $ 32 $ 6,197 .36% $ 22

Lender partners ............. 11,819 1.82 215 10,541 1.60 169

Total Preferred Channel...... 20,893 1.18 247 16,738 1.14 191

Other purchases(1) ........... 2,479 3.83 95 8,436 4.60 388

Subtotal basepurchases....... 23,372 1.46 342 25,174 2.30 579

Consolidations .............. 4,672 2.24 105 2,609 2.18 57

Total....................... $28,044 1.59% $ 447 $ 27,783 2.29% $636

(1) Primarily includes spot purchases, other commitment clients, and subsidiary acquisitions.

The increase in the lender partner premium rate from 2004 to 2005 is primarily due to the increase in

zero-fee lending, where we pay an origination fee on behalf of the borrower, and school-as-lender volume.

The borrower origination fee related to zero-fee lending will be gradually phased out by Reauthorization

Legislation from 2007 to 2010. This legislation also ends new schools-as-lender after April 1, 2006 and adds

additional requirements for schools already participating in this program. (See “OTHER RELATED

EVENTS AND INFORMATION—Reauthorization.”)