Sallie Mae 2005 Annual Report Download - page 137

Download and view the complete annual report

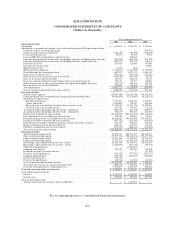

Please find page 137 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-15

2. Significant Accounting Policies (Continued)

The Company holds rights that can affect the remarketing of specific bonds in certain Consolidation

Loan securitization structures. These remarketing rights are not significantly limited and therefore these

securitizations did not meet the criteria of being a QSPE and are accounted for on-balance sheet as VIEs.

Retained Interest

The Company securitizes its student loan assets and for transactions qualifying as sales retains

Residual Interests and servicing rights (as the Company retains the servicing responsibilities), all of which

are referred to as the Company’s Retained Interest in off-balance sheet securitized loans. The Residual

Interest is the right to receive cash flows from the student loans and reserve accounts in excess of the

amounts needed to pay servicing, derivative costs (if any), other fees, and the principal and interest on the

bonds backed by the student loans. The investors of the securitization trusts have no recourse to the

Company’s other assets should there be a failure of the student loans to pay when due.

When the Company qualifies for sale treatment on its FFELP Stafford, Private Education, and certain

of the Consolidation Loan securitizations, it recognizes the resulting gain on student loan securitizations

on the consolidated statements of income. This gain is based upon the difference between the allocated

cost basis of the assets sold and the relative fair value of the assets received. The component in

determining the fair value of the assets received that involves the most judgment is the Residual Interest.

The Company estimates the fair value of the Residual Interest, both initially and each subsequent quarter,

based on the present value of future expected cash flows using management’s best estimates of the

following key assumptions—credit losses, prepayment speeds, the forward interest rate curve and discount

rates commensurate with the risks involved. Quoted market prices are not available. The Company

accounts for its Residual Interests as available-for-sale securities. Accordingly, Residual Interests are

reflected at market value with temporary changes in market value reflected as a component of

accumulated other comprehensive income in stockholders’ equity.

The fair value of the Fixed Rate Embedded Floor Income is a component of the Residual Interest and

is determined both initially at the time of the sale of the student loans and each subsequent quarter. This

estimate is based on an option valuation and a discounted cash flow calculation that considers the current

borrower rate, Special Allowance Payment (“SAP”) spreads and the term for which the loan is eligible to

earn Floor Income as well as time value, forward interest rate curve and volatility factors. Variable Rate

Floor Income received is recorded as earned in securitization income.

The Company records interest income and periodically evaluates its Residual Interests for other than

temporary impairment in accordance with the Emerging Issues Task Force (“EITF”) Issue No. 99-20

“Recognition of Interest Income and Impairment on Purchased and Retained Beneficial Interests in

Securitized Financial Assets.” Under this guidance, each quarter, the Company estimates the cash flows to

be received from its Residual Interests which are used prospectively to calculate a yield for income

recognition. In cases where the Company’s estimate of future cash flows results in a decrease in the yield

used to recognize interest income compared to the prior quarter, the Residual Interest is written down to

fair value, first to the extent of any unrealized gain in accumulated other comprehensive income, then

through earnings as an other than temporary impairment.

The Company also receives income for servicing the loans in its securitization trusts which is

recognized as earned. The Company assesses the amounts received as compensation for these activities at